IBM 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

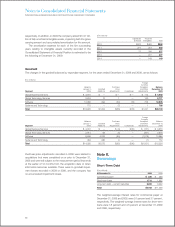

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

are no longer exempt from consolidation under the amended

guidance. The amendments also limit the circumstances in which

a financial asset, or a portion of a financial asset, should be derec-

ognized when the transferor has not transferred the entire original

financial asset to an entity that is not consolidated with the trans-

feror in the financial statements being presented, and/or when

the transferor has continuing involvement with the transferred

financial asset. The company will adopt these amendments

for interim and annual reporting periods beginning on January

1, 2010. The company does not expect the adoption of these

amendments to have a material impact on the Consolidated

Financial Statements.

Standards Implemented

In September 2009, the FASB issued amended guidance con-

cerning fair value measurements of investments in certain entities

that calculate net asset value per share (or its equivalent). If fair

value is not readily determinable, the amended guidance permits,

as a practical expedient, a reporting entity to measure the fair

value of an investment using the net asset value per share (or its

equivalent) provided by the investee without further adjustment.

In accordance with the guidance, the company adopted these

amendments for the year ended December 31, 2009. There was

no material impact on the Consolidated Financial Statements.

On July 1, 2009, the FASB issued the FASB Accounting

Standards Codification (the Codification). The Codification became

the single source of authoritative nongovernmental U.S. GAAP,

superseding existing FASB, American Institute of Certified Public

Accountants (AICPA), Emerging Issues Task Force (EITF) and

related literature. The Codification eliminates the previous U.S.

GAAP hierarchy and establishes one level of authoritative GAAP.

All other literature is considered non-authoritative. The Codifica-

tion was effective for interim and annual periods ending after

September 15, 2009. The company adopted the Codification for

the quarter ending September 30, 2009. There was no impact

to the consolidated financial results.

In May 2009, the FASB issued guidelines on subsequent

event accounting which sets forth: 1) the period after the bal-

ance sheet date during which management of a reporting entity

should evaluate events or transactions that may occur for poten-

tial recognition or disclosure in the financial statements; 2) the

circumstances under which an entity should recognize events

or transactions occurring after the balance sheet date in its

financial statements; and 3) the disclosures that an entity should

make about events or transactions that occurred after the bal-

ance sheet date. These guidelines were effective for interim and

annual periods ending after June 15, 2009, and the company

adopted them in the quarter ended June 30, 2009. There was

no impact on the consolidated financial results.

In April 2009, the FASB issued additional requirements regard-

ing interim disclosures about the fair value of financial instruments

which were previously only disclosed on an annual basis. Entities

are now required to disclose the fair value of financial instruments

which are not recorded at fair value in the financial statements in

both interim and annual financial statements. The new require-

ments were effective for interim and annual periods ending after

June 15, 2009 on a prospective basis. The company adopted

these requirements in the quarter ended June 30, 2009. There

was no impact on the consolidated financial results as this relates

only to additional disclosures in the quarterly financial statements.

See note E, “Financial Instruments (Excluding Derivatives)”, on

pages 87 and 88.

On January 1, 2009, the company adopted the revised FASB

guidance regarding business combinations which was required

to be applied to business combinations on a prospective basis.

The revised guidance requires that the acquisition method of

accounting be applied to a broader set of business combina-

tions, amends the definition of a business combination, provides

a definition of a business, requires an acquirer to recognize

an acquired business at its fair value at the acquisition date

and requires the assets and liabilities assumed in a business

combination to be measured and recognized at their fair values

as of the acquisition date (with limited exceptions). There was

no impact upon adoption and the effects of this guidance will

depend on the nature and significance of business combinations

occurring after the effective date. See note C, “Acquisitions/

Divestitures”, on pages 82 to 86 for further information regarding

2009 business combinations.

In April 2009, the FASB issued an amendment to the revised

business combination guidance regarding the accounting for

assets acquired and liabilities assumed in a business combi-

nation that arise from contingencies. The requirements of this

amended guidance carry forward without significant revision

the guidance on contingencies which existed prior to January

1, 2009. Assets acquired and liabilities assumed in a business

combination that arise from contingencies are recognized at fair

value if fair value can be reasonably estimated. If fair value can-

not be reasonably estimated, the asset or liability would generally

be recognized in accordance with the Accounting Standards

Codification (ASC) Topic 450 on contingencies. There was no

impact upon adoption. See note C, “Acquisitions/Divestitures”,

on pages 82 to 86 for further information regarding 2009 busi-

ness combinations.

In April 2008, the FASB issued new requirements regard-

ing the determination of the useful lives of intangible assets. In

developing assumptions about renewal or extension options

used to determine the useful life of an intangible asset, an entity

needs to consider its own historical experience adjusted for

entity-specific factors. In the absence of that experience, an

entity shall consider the assumptions that market participants

would use about renewal or extension options. The new require-

ments apply to intangible assets acquired after January 1, 2009.

The adoption of these new rules did not have a material impact

on the Consolidated Financial Statements.

80