IBM 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES

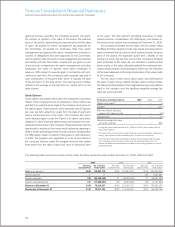

Commitments

The company’s extended lines of credit to third-party entities

include unused amounts of $3,576 million and $3,857 million at

December 31, 2009 and 2008, respectively. A portion of these

amounts was available to the company’s business partners to

support their working capital needs. In addition, the company

has committed to provide future financing to its clients in con-

nection with client purchase agreements for approximately

$2,788 million and $3,342 million at December 31, 2009 and

2008, respectively. The change over the prior year was due to

decreased signings of long-term IT infrastructure arrangements

in which financing is committed by the company to fund a cli-

ent’s future purchases from the company.

The company has applied the guidance requiring a guaran-

tor to disclose certain types of guarantees, even if the likelihood

of requiring the guarantor’s performance is remote. The follow-

ing is a description of arrangements in which the company is

the guarantor.

The company is a party to a variety of agreements pursuant

to which it may be obligated to indemnify the other party with

respect to certain matters. Typically, these obligations arise in

the context of contracts entered into by the company, under

which the company customarily agrees to hold the other party

harmless against losses arising from a breach of representations

and covenants related to such matters as title to assets sold,

certain IP rights, specified environmental matters, third-party

performance of nonfinancial contractual obligations and certain

income taxes. In each of these circumstances, payment by

the company is conditioned on the other party making a claim

pursuant to the procedures specified in the particular contract,

which procedures typically allow the company to challenge the

other party’s claims. While typically indemnification provisions

do not include a contractual maximum on the company’s pay-

ment, the company’s obligations under these agreements may

be limited in terms of time and/or nature of claim, and in some

instances, the company may have recourse against third parties

for certain payments made by the company.

It is not possible to predict the maximum potential amount of

future payments under these or similar agreements due to the

conditional nature of the company’s obligations and the unique

facts and circumstances involved in each particular agreement.

Historically, payments made by the company under these agree-

ments have not had a material effect on the company’s business,

financial condition or results of operations.

In addition, the company guarantees certain loans and finan-

cial commitments. The maximum potential future payment under

these financial guarantees was $85 million and $50 million at

December 31, 2009 and 2008, respectively. The fair value of the

guarantees recognized in the Consolidated Statement of Financial

Position is not material.

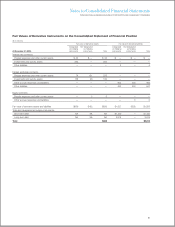

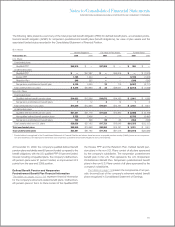

Note P.

Taxes

($ in millions)

For the year ended December 31: 2009 2008 2007

Income from continuing operations

before income taxes:

U.S. operations $ 9,524 $ 8,424 $ 7,667

Non-U.S. operations 8,614 8,291 6,822

Total income from continuing

operations before income taxes $18,138 $16,715 $14,489

The continuing operations provision for income taxes by geo-

graphic operations is as follows:

($ in millions)

For the year ended December 31: 2009 2008 2007

U.S. operations $2,427 $2,348 $2,280

Non-U.S. operations 2,286 2,033 1,791

Total continuing operations

provision for income taxes $4,713 $4,381 $4,071

The components of the continuing operations provision for

income taxes by taxing jurisdiction are as follows:

($ in millions)

For the year ended December 31: 2009 2008 2007

U.S. federal:

Current $ 473 $ 338 $1,085

Deferred 1,341 1,263 683

1,814 1,601 1,768

U.S. state and local:

Current 120 216 141

Deferred 185 205 (19)

305 421 122

Non-U.S.:

Current 2,347 1,927 2,105

Deferred 247 432 76

2,594 2,359 2,181

Total continuing operations

provision for income taxes 4,713 4,381 4,071

Provision for social security, real estate,

personal property and other taxes 3,986 4,076 3,832

Total taxes included in income

from continuing operations $8,699 $8,457 $7,903

101