Experian 2010 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

Introduction

2 – 11

Business review

12 – 51

Governance

52 – 84

Financial statements

85 – 160

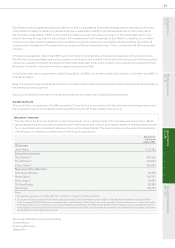

Notes to the Group nancial statements

for the year ended 31 March 2010

1. Corporate information

Experian plc (the ‘Company’), which is the ultimate parent company of the Experian group of companies (‘Experian’ or the

‘Group’), is incorporated and registered in Jersey under Jersey Companies Law as a public company limited by shares and is

resident in Ireland. The address of its registered ofce is 22 Grenville Street, St Helier, Jersey JE4 8PX. The Company’s shares

are traded on the London Stock Exchange’s Regulated Market. Experian is a global information services group.

The consolidated nancial statements of Experian plc and its subsidiary undertakings were approved by the Board on 19 May 2010.

2. Basis of preparation

The Group nancial statements are prepared in accordance with International Financial Reporting Standards (‘IFRS’ or ‘IFRSs’)

as adopted for use in the European Union (the ‘EU’) and International Financial Reporting Interpretations Committee (‘IFRIC’)

interpretations applicable to companies reporting under IFRS. Although the Company is incorporated and registered in Jersey,

the Group nancial statements are designed to include disclosures sufcient to comply with those parts of the UK Companies

Act 2006 applicable to companies reporting under IFRS.

The Group nancial statements are presented in US dollars, as this is the most representative currency of the Group’s

operations, and they are rounded to the nearest million. They are prepared under the historical cost convention, as modied

for the revaluation of available for sale nancial assets and certain other nancial assets and nancial liabilities including

derivatives. The principal exchange rates used in preparing the Group nancial statements are set out in note 7.

In compliance with the requirements for companies whose shares are traded on the London Stock Exchange’s Regulated Market,

the nancial statements of the Company are included within the Group annual report and are set out on pages 150 to 158. These

nancial statements, prepared under UK accounting standards, are now also prepared and presented in US dollars as the US

dollar is the currency of the primary economic environment in which the Company operated during the year.

3. Recent accounting developments

Signicant accounting developments

There have been three signicant developments in nancial reporting which became effective for Experian at the start of the

current nancial year and these have been taken into account in the presentation of the Group nancial statements. With these

exceptions, the Group nancial statements have been prepared on a basis consistent with that adopted for the year ended

31 March 2009. These three developments are:

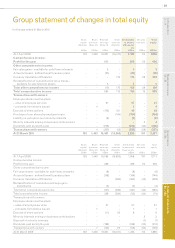

IAS 1 ‘Amendment – Presentation of Financial Statements’

This revised standard requires that the Group statement of changes in total equity is now presented as a primary statement. The

standard also prohibits the presentation of items of income and expense within this statement and requires such ‘non-owner

changes in equity’ to be presented separately from ‘owner changes in equity’. Accordingly the standard requires that all ‘non-

owner changes in equity’ are shown in a performance statement and, as permitted by the standard, the Group has elected to

comply with this requirement by presenting a Group income statement and a Group statement of comprehensive income. Items

in the Group statement of comprehensive income and Group statement of changes in total equity are shown net of related tax.

IFRS 7 ‘Improving Disclosures about Financial Instruments’

This amendment requires enhanced disclosures about fair value measurement and liquidity risk.

IFRS 8 ‘Operating Segments’

Segment information is now prepared in accordance with the requirements of IFRS 8, with further information thereon given in

note 6.

Other accounting developments

The following accounting standards, amendments and interpretations issued by the IASB and the IFRIC are effective for the

Group’s accounting periods beginning on or after 1 April 2009 but have had no material effect on the results or nancial position

of the Group disclosed within these nancial statements:

Amendment to IFRS 2 – ‘Share-Based Payments’ -

Amendment to IAS 23 – ‘Borrowing Costs’ -

Amendments to IAS 32 and IAS 1 – ‘Puttable Financial Instruments and Obligations Arising on Liquidation’ -

Amendments to IAS 39 and IFRS 7 – ‘Reclassication of Financial Instruments’ -

Improvements to IFRSs (May 2008) -

IFRIC 13 –‘Customer Loyalty Programmes’ -

IFRIC 15 –‘Agreements for the Construction of Real Estate’ -

IFRIC 16 –‘Hedges of a Net Investment in a Foreign Operation’ -