Experian 2010 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

Introduction

2 – 11

Business review

12 – 51

Financial statements

85 – 160

Governance

52 – 84

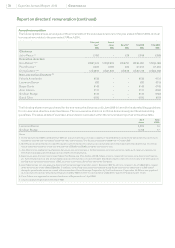

Share options

Details of options granted to directors under the Experian share option plan and the GUS executive share option schemes are

set out in the table below.

Date of grant

Number of

options at

1 April

2009

Exercise

price G r a n t e d E x e r c i s e d

Market price

on day of

exercise Lapsed

Total number of

options at

31 March 2010

Date from

which

exercisable/

expiry date

Chairman

John Peace (1) 06.06.02 176,882 367.5p –176,882 493.0p –

19.06.03 176,251 380.1p –176,251 493.0p –

01.06.04 166,894 455.4p – 166,894 475.0p –

31.05.05 166,625 483.1p – – – 166,625

02.06.06 167,912 521.1p – – – 167,912

–

Executive directors

Don Robert (2) 01.06.04 239,699 455.4p – – – – 11.10.06 – 30.05.10

31.05.05 132,091 483.1p – – – – 31.05.08 – 30.05.15

02.06.06 133,184 521.1p – – – – 02.06.09 – 01.06.16

18.06.09 –464.0p 552,453 – – – 18.06.12 – 17.06.19

1,057,427

Paul Brooks 31.05.05 59,368 48 3.1p – – – – 31.05.08 – 30.05.15

02.06.06 54,883 521.1p – – – – 02.06.09 – 01.06.16

18.06.09 –464.0p 198,275 – – – 18.06.12 – 17.06.19

312,526

Chris Callero 01.06.04 120,150 455.4p –120,150 589.0p –

31.05.05 142,862 48 3.1p – – – – 11.10.0 6 – 30.05.11

02.06.06 153,675 521.1p – – – – 02.06.09 – 01.06.12

18.06.09 –464.0p 236,765 – – – 18.06.12 – 17.06.19

533,302

Non-executive directors

David Tyler (3) 06.06.02 103,407 367.5p –103,407 599.0p –

19.06.03 102,595 38 0.1p –102,595 597.5p –

01.06.04 103,212 455.4p –103,212 615.0p –

31.05.05 103,494 483.1p –103,494 635.5p –

02.06.06 104,585 521.1p – – – – 02.06.09 – 01.06.16

104,585

Notes:

1. John Peace ceased to be an employee of the Group on 31 March 2007. Under the GUS Unapproved Executive Share Option Scheme rules, he had six

months from this date to exercise his options, excluding any periods during which he was restricted from dealing in the Group’s shares. John Peace’s

unexercised options lapsed on 7 June 2009.

2. Options granted to Don Robert prior to his date of appointment to the board of GUS plc in April 2005 were granted under the GUS North America Stock

Option Plan. The 2005 and 2006 grants were made under the GUS Executive Share Option Scheme.

3. Options were granted to David Tyler in respect of his role as an executive director of GUS plc. On demerger, he was eligible to exchange his options for

equivalent options over Experian shares on the same basis as other participants in the relevant GUS plans except that he was not eligible to participate in

the Experian reinvestment plan.

4. Options granted in 2006 or earlier were originally granted under the GUS executive share option schemes. Options which were granted before 2005 were

exchanged for equivalent options over Experian plc shares on demerger. Unvested options granted in 2005 and 2006 (other than options granted under the

GUS 1998 Approved Executive Share Option Scheme) were automatically exchanged for equivalent options over Experian plc shares. The performance

condition for options granted to all directors, with the exception of Chris Callero, in 2005 and 2006 was based on the growth of Experian’s earnings per share

in excess of the UK Retail Price Index from the date of demerger. The options granted to Chris Callero prior to 2009 were granted under the GUS North

America Stock Option Plan. Vesting of these options was not subject to performance conditions.

5. Option grants made in June 2006 were subject to the performance condition described in the section titled ‘Outcome of performance testing determined in

2009/10’. This performance condition was achieved and so these options vested on 2 June 2009.

6. The market price of Experian plc shares at the end of the nancial year was 648.5p; the highest and lowest prices during the nancial year were 661p and

433p respectively.

74