Experian 2010 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Financial statements126

Notes to the Group nancial statements (continued)

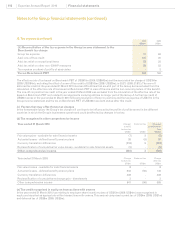

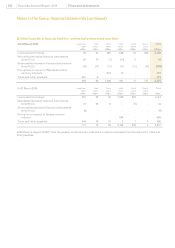

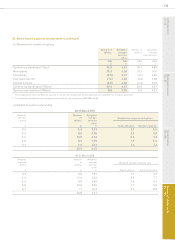

24. Loans and borrowings (continued)

The accounting policies for nancial instruments set out in note 4 have been applied to the above items. There is no material

difference between the carrying values of the Group’s loans and borrowings and their fair values.

During the year ended 31 March 2010, the Group issued 4.75% Guaranteed notes 2020 with a nominal value of €500m at an issue

price of 99.914%. During the year ended 31 March 2010, 6.375% Eurobonds 2009 with a par value of £203m were redeemed at their

date of maturity (2009: £147m).

The effective interest rate for the bonds and notes approximates to the nominal rate indicated above. The effective interest rate

for overdrafts at 31 March 2010 is 1.5% (2009: 2.0%).

Other than nance lease obligations, all the borrowings of the Group shown above are unsecured. Finance lease obligations are

effectively secured as the rights to the leased assets revert to the lessor in the event of default.

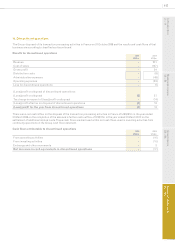

(b) Analysis of loans and borrowings by contractual repricing dates:

2010

US$m

2009

US$m

Less than one year 615 1,794

One to two years 3 3

Two to three years - 2

Three to four years 552 -

Four to ve years - 518

Over ve years 681 -

1,851 2,317

(c) Analysis of loans and borrowings by currency:

2010

US$m

2009

US$m

US dollar 941 1,480

Sterling 561 827

Brazilian real 7 9

Euro 342 1

1,851 2,317

The above analysis takes account of forward foreign exchange contracts and cross currency swaps.

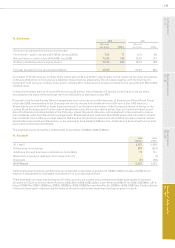

(d) Finance lease obligations - minimum lease payments due:

2010

US$m

2009

US$m

In less than one year 5 5

In two to ve years 4 6

Total minimum lease payments 9 11

Future nance charges on nance leases (1) (2)

Present value of nance leases 8 9

The present value of nance leases falls due:

In less than one year 5 4

In two to ve years 3 5

Present value of nance leases 8 9

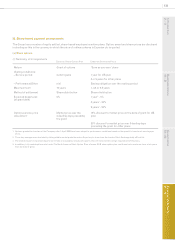

(e) Borrowing facilities

At 31 March 2010, the Group had undrawn committed borrowing facilities of US$1,932m (2009: US$1,050m) which expire more

than two years after the balance sheet date. These facilities are in place for general corporate purposes, including the nancing

of acquisitions.