Experian 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Business review20

North America (continued)

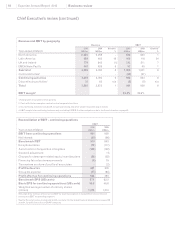

Total revenue growth Organic revenue growth

from databreach revenue. Product

and user experience enhancements

contributed to improved retention

rates, while the new identity monitoring

product ProtectMyID performed in

line with expectations, with good order

volume growth since launch.

On 23 February 2010, Experian received

nal rules from the Federal Trade

Commission (FTC) governing the

marketing of free credit reports to

US consumers. These regulations

require specic disclosures and links

to the FTC-sponsored website. With

effect from 1 April 2010, Experian

adapted its marketing strategy and

switched all broadcast and internet

advertising placements to a new

consumer brand, freecreditscore.

com. Based on recent dialogue with

the Federal Trade Commission, further

changes to the freecreditreport.com

site were implemented to resolve

lingering concerns about disclosures

in advertising.

Financial review

Total revenue for the year from

continuing activities was US$2,060m

(2009: US$2,059m).

EBIT from direct businesses was

US$572m (2009: US$575m), a decrease

of 1% in the year, giving an EBIT margin

of 27.8% (2009: 27.9%).

The margin performance reected

strong delivery on cost reductions,

including some one-off benets, which

helped to offset negative operating

leverage in Credit Services and

Marketing Services.

EBIT from FARES, the 20%-owned

real estate information associate,

increased to US$56m (2009: US$48m),

driven by higher mortgage renancing

activity.

Social, ethical and environmental

(SEE) risks and opportunities

Experian in North America delivered a

programme of energy saving measures

across its data centres, as well as

engaging employees in volunteering

and online charitable donations and

considerably expanding the reach of its

consumer education programme.

Marketing Services

Total and organic revenue at Marketing

Services declined by 8%. In the early

part of the year, contraction in retail

spending impacted the traditional

activities of list processing, data and

database, although there were signs

of stabilisation as the year progressed.

Digital media activities delivered good

growth, reecting the ongoing shift to

more cost-effective and more targeted

channels. During the year, Experian

has invested in new capabilities and

innovative new products to strengthen

its market position and provide new

growth opportunities as the economy

recovers.

Interactive

Total and organic revenue growth was

8% at Interactive. There was strong

growth in lead generation, driven by an

excellent performance in the education

vertical, reecting client gains, and an

improving trend in the year within the

lending vertical. Comparison shopping

revenues beneted from a number of

new partnerships with co-branded

partners. Increased membership

revenue and afnity channel

penetration drove growth at Consumer

Direct, offsetting a lower contribution

10 0%

08 3%

07 8%

06 15%

1%

09

Organic growth Acquired growth

09 1%

0%10

EBIT (US$m) and margin

EBIT excludes discontinuing activities

EBIT margin is for continuing direct business only

and excludes FARES

EBIT

27.8%10 628

26.9%08 608

25.8%07 573

23.3%06 473

27.9%

09 623

06 40%

15%

07

08 4%

49

48