Experian 2010 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Financial statements102

Notes to the Group nancial statements (continued)

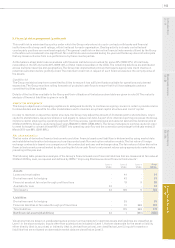

5. Financial risk management (continued)

The Group has investments in undertakings with other functional currencies, whose net assets are exposed to foreign exchange

translation risk. In order to reduce the impact of currency uctuations on the value of such entities, the Group has a policy of

borrowing in US dollars and euros, as well as in sterling, and of entering into forward foreign exchange contracts in the relevant

currencies. The sensitivity reported in respect of sterling against the US dollar is wholly attributable to such net exposures.

Otherwise the above analysis excludes the impact of foreign exchange risk on the translation of the net assets of such

undertakings.

Interest rate risk

The Group’s interest rate risk arises principally from its net debt and the portions thereof at variable rates which expose the

Group to such risk.

The Group has a policy of normally maintaining between 30% and 70% of net debt at rates that are xed for more than one year.

The Group’s interest rate exposure is managed by the use of xed and oating rate borrowings and by the use of interest rate

swaps and cross currency interest rate swaps to adjust the balance of xed and oating rate liabilities. The Group also mixes the

duration of its borrowings to smooth the impact of interest rate uctuations.

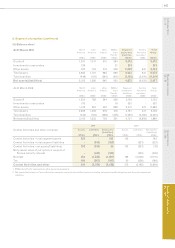

On the basis of the prole of net debt and an assessment of reasonably possible changes in the principal interest rates, the

Group’s sensitivity to interest rate risk can be quantied as follows with all other variables held constant:

Interest rate exposure 2010 2009

On US dollar denominated net debt:

Interest rate movement 1.7%

higher

1.6%

higher

Effect on prot for the year * US$15m

higher

US$4m

higher

On sterling denominated net debt:

Interest rate movement 2.0%

higher

1.0%

higher

Effect on prot for the year * US$3m

higher

US$4m

higher

On Brazilian real denominated net debt:

Interest rate movement 1.4%

higher

2.9%

higher

Effect on prot for the year US$nil US$1m

higher

On euro denominated net debt:

Interest rate movement 1.7%

higher

1.0%

higher

Effect on prot for the year ** US$3m

lower

US$2m

higher

* primarily as a result of higher interest income on interest rate swaps offset by higher interest expense on oating rate borrowings.

** primarily as a result of higher interest expense on loans in 2010 (and higher interest income on interest rate swaps in 2009).

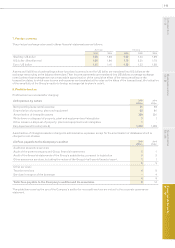

Price risk

The Group is exposed to price risk in connection with investments classied on the balance sheet as available for sale nancial

assets. Such investments are primarily held to provide security in connection with unfunded pension obligations and are

managed by independent fund managers who seek to mitigate such risk by diversication of the portfolio.

At 31 March 2010, if the relevant stock market and other indices had been 10% higher/lower with all other variables held constant,

no further signicant gains/losses would have been recognised in the Group statement of comprehensive income.

Credit risk

In the case of derivative nancial instruments, deposits and trade receivables, the Group is exposed to credit risk, which results

from the non-performance of contractual agreements on the part of the contracted party.