Experian 2010 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Financial statements114

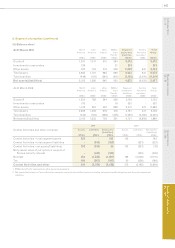

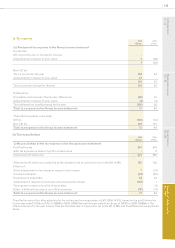

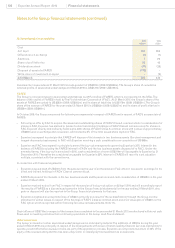

11. Net nance costs

2010

US$m

2009

US$m

(a) Net nance costs

Interest income:

Bank deposits and money market funds 17 16

Interest differential on derivatives 2 12

Expected return on pension plan assets 47 69

Interest income 66 97

Financing fair value gains:

Fair value gains on borrowings attributable to currency risk 16 -

Gains on interest rate swaps - fair value hedges 353

Fair value gains on non-hedging derivatives 53 -

Foreign exchange transaction gains 58 11

Movement in fair value of Serasa put option (note 5) - 21

Financing fair value gains 130 85

Finance income 196 182

Interest expense:

Bank loans and overdrafts 19 41

Eurobonds and notes 41 61

Commitment and facility utilisation fees 2 1

Unwind of discount on provisions 5 6

Interest differential on derivatives 31 30

Finance lease interest expense 1 2

Interest expense on pension plan liabilities 48 52

Interest expense 147 193

Financing fair value losses:

Fair value losses on borrowings attributable to interest rate risk 451

Losses on cross currency swaps - fair value hedges 22 -

Fair value losses on non-hedging derivatives -15

Movement in fair value of Serasa put option (note 5) 113 -

Financing fair value losses 139 66

Finance expense 286 259

Net nance costs 90 77

(b) Net interest expense included in Benchmark PBT

Net nance costs 90 77

Financing fair value remeasurements (9) 19

Net interest expense included in Benchmark PBT 81 96

(c) Financing fair value remeasurements included in net nance costs

Financing fair value gains (130) (85)

Financing fair value losses 139 66

Charge/(credit) in respect of nancing fair value remeasurements 9 (19)

An indication of the sensitivity of the Group’s results to interest rate risk is given in note 5.

Notes to the Group nancial statements (continued)