Experian 2010 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Introduction

2 – 11

Governance

52 – 84

Financial statements

85 – 160

Business review

12 – 51

Delivering innovative data and analytics

We are investing in our data sources,

our platforms and our products across

the globe to bring the fresh insights

and innovation that our customers

need. For example, we are beneting

from recent addition of income data

in our US consumer credit bureau;

we are enhancing our products and

platforms in business information;

we are developing new analytics

which will extend our fraud prevention

capabilities; we are introducing new

digital advertising services within

our marketing business and we are

investing further behind the launch of

ProtectMyID, our identity monitoring

tool for consumers.

Executing superior sales

and operations

Growth in our business will be delivered

by our people and we are investing

in our business to sustain our high

performance sales culture and to

maximise efciency across

our operations.

These initiatives, along with targeted,

inll acquisitions that are tightly

coupled to the core, are central to our

goal of delivering strong, sustainable

returns for our shareholders.

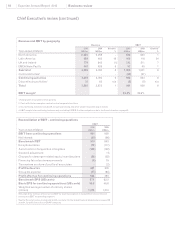

Net debt

Net debt was reduced by US$483m

to US$1,627m at 31 March 2010,

after funding capital expenditure of

US$314m, and net share purchases

of US$114m by employee trusts and in

respect of employee share incentive

plans. In addition, there was a net

inow of US$66m from disposals net of

acquisitions. As at 31 March 2010, the

net debt to EBITDA gearing ratio was

1.8x, which is at the lower end of our

1.75-2.0x adjusted target debt range.

The gearing ratio is adjusted to include

the put option over the 30% minority

stake in Serasa, valued at US$661m at

31 March 2010.

Debt funding

During the year, we started an 18

month programme to renance our

bank and bond facilities with an

issuance in February 2010 of €500m

Guaranteed notes at 4.75% due 2020,

which was swapped into US dollars.

This programme will continue in the

year ending 31 March 2011, as we aim

to spread debt maturities and diversify

our sources of funding. The marginal

cost of new funding sources is higher

than the funds being replaced and, as

a result, for the year ending 31 March

2011, our current expectation is that net

interest expense will be in the range of

US$90-100m.

Capital strategy

We have recently undertaken a re-

evaluation of our capital policy and

payout ratios in light of the investment

needs of the business, the reduction in

total net debt and ongoing strength in

cash generation. We remain committed

to a prudent but efcient balance sheet

consistent with our desire to retain a

strong investment grade credit rating.

Our target gearing ratio, net debt

adjusted for the current value of the

put option over the minority shares in

Serasa, divided by EBITDA, will remain

unchanged at 1.75-2.0x.

We anticipate that continuing strength

in our cash generation, as well as

receipts from the FARES disposal,

will result in net debt being below

our gearing targets. Accordingly, it

is our current intention to adjust our

distribution policies to shareholders as

follows:

We intend to increase our dividend •

payout ratio over the next twelve

months. By the time of the second

interim dividend next year, we expect

to have dividend cover based on

Benchmark EPS of around 2.5 times

on an annual basis; our previous

policy was to have cover on this basis

of at least three times.

We will commence a share buyback •

programme of around US$300m, to

be implemented over the next twelve

months, subject to free cash ow

and acquisition expenditure. It is

planned to repurchase an additional

US$50m to satisfy employee share

incentive plans. The total share

repurchase over the next twelve

months is therefore expected to be

approximately US$350m.

Dividend

For the year ended 31 March 2010, we

have announced a second interim

dividend of 16.00 US cents per share.

This gives a full-year dividend of

23.00 US cents per share, 2.9 times

covered by Benchmark EPS, and up

15% as we transition to our increased

dividend payout. The second interim

dividend will be paid on 23 July 2010

to shareholders on the register at the

close of business on 25 June 2010.

Changes to external

reporting calendar

We have undertaken a review of

nancial reporting frequency in order

to bring greater efciency to our

external reporting. Henceforth, we will

issue nancial updates on a quarterly

basis only. This brings us into line with

reporting frequencies across our peer

group. Going forward, our nancial

calendar will include the Q1 Interim

Management Statement (in July), the

half-yearly report (in November), the

Q3 Interim Management Statement

(in January) and the preliminary

results (in May). We aim to accelerate

the reporting of our half-yearly and

preliminary results starting in the year

ending 31 March 2012.

Our people

The strength of our performance is

down to the outstanding achievements

of our people. It is reective of a terric

effort by our employees, in the face of

some tough market conditions. I salute

their dedication and commitment and I

would like to take this opportunity

to thank all our employees for their

single -mindedness and strength of

purpose over the past year.

49

160