Experian 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Business review18

North America

North America delivered a robust performance, notwithstanding recessionary

market conditions. Growth in Interactive offset weakness elsewhere and cost

efciencies enabled margins to be broadly maintained.

(healthcare payments) annualised in the

period, and delivered good growth, with

deeper penetration of both existing and

new hospitals.

Decision Analytics

Total and organic revenue declined

by 3% in the year, reecting client

hesitancy to spend on major software

installations. This was partially

mitigated by growth in analytics and

fraud prevention tools, with client

focus largely directed towards risk

management tools, such as loan loss

forecasting, credit criteria evaluation

and risk-based pricing. There was good

progress in the start-up public sector

vertical, where both the pipeline and

conversions have grown.

Credit Services

Total revenue at Credit Services

declined by 5%, with organic

revenue down 6%. Within consumer

information, the depressed

environment for consumer lending

gave rise to declines in the prospecting

and credit origination categories. This

was partially offset by solid growth

in portfolio management, as lenders

focused on risk mitigation. Business

information performed well, reecting

investment in data and product

innovation, as well as strong sales

execution during the year. There was

a resilient performance at automotive,

which beneted as the year progressed

from the addition of new accident

data. The Search

America

acquisition

Client focus on risk •

mitigation helps offset

weak lending market

Good growth in digital •

marketing as spending

shifts to more cost-

effective media

Strong Interactive •

performance; organic

revenue up 8%

EBIT margin of 27.8% •

reects strong delivery

on cost reductions

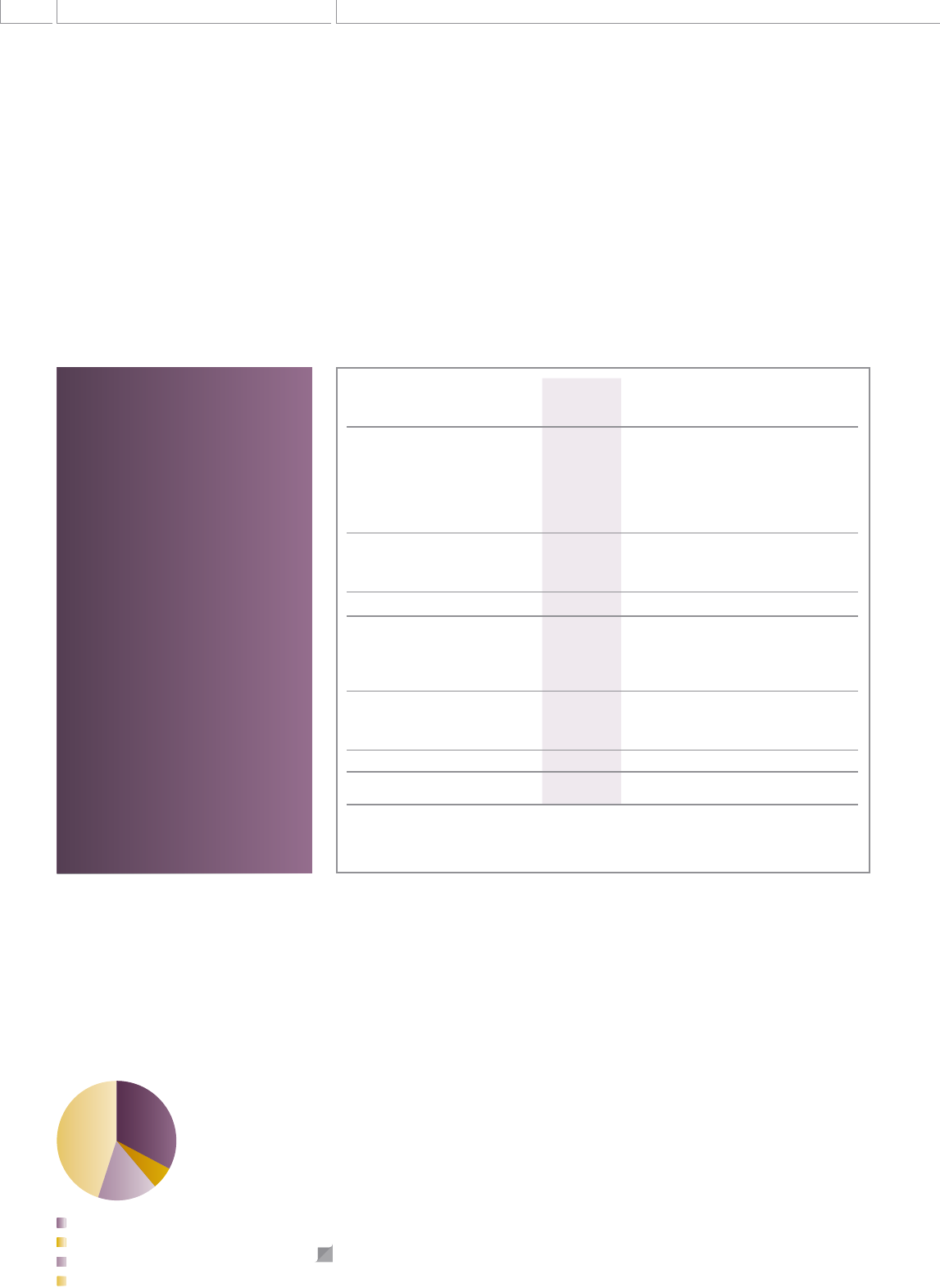

2010 Revenue by activity1

Decision Analytics

Credit Services

Marketing Services

Interactive

1 Excludes discontinuing activities

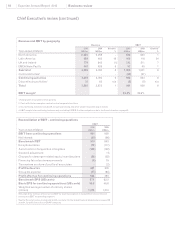

Year ended 31 March

2010

US$m

2009

US$m

Total

growth1

%

Organic

growth1

%

Revenue

Credit Services 693 730 (5) (6)

Decision Analytics 116 119 (3) (3)

Marketing Services 329 358 (8) (8)

Interactive 922 852 8 8

Total – continuing

activities 2,060 2,059 - -

Discontinuing activities2824 n/a

Total North America 2,068 2,083 (1)

EBIT

Direct business 572 575 (1)

FARES 56 48 16

Total – continuing

activities 628 623 1

Discontinuing activities2(5) (7) n/a

Total North America 623 616 1

EBIT margin327.8% 27.9%

1. Growth at constant exchange rates

2. Discontinuing activities include an online data survey business and the National Business Database

3. EBIT margin is for continuing business only, excluding FARES

47