Experian 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Business review44

The Board formed a judgment at the

time of approving the Group and the

parent company nancial statements

that there was a reasonable expectation

that the Group and the Company

had adequate resources to continue

in operational existence for the

foreseeable future. In arriving at this

conclusion the Board took account

of current and anticipated trading

performance, together with the current

and anticipated levels of net debt

and the availability of the committed

borrowing facilities detailed above.

For this reason, the going concern

basis continues to be adopted in the

preparation of the Group and the parent

company nancial statements.

Use of non-GAAP nancial

information

Experian has identied certain

measures that it believes will assist

understanding of the performance

of the Group. As these measures are

not dened under IFRS, they may not

be directly comparable with other

companies’ adjusted measures. The

non-GAAP measures are not intended

to be a substitute for, or superior to,

any IFRS measures of performance

but management has included them as

these are considered to be important

comparables and key measures used

within the business for assessing

performance. Such non-GAAP

measures that are included within the

Group nancial statements are detailed

in note 4 to those nancial statements.

Further non-GAAP measures and

reconciliations of those measures are

set out below.

Earnings before interest, tax,

depreciation and amortisation

(‘EBITDA’)

EBITDA is dened as prot before

amortisation of acquisition intangibles,

goodwill impairments, charges in

respect of the demerger-related equity

incentive plans, exceptional items, net

nancing costs, tax, depreciation and

other amortisation. It includes

the Group’s share of associates’

pre-tax prot.

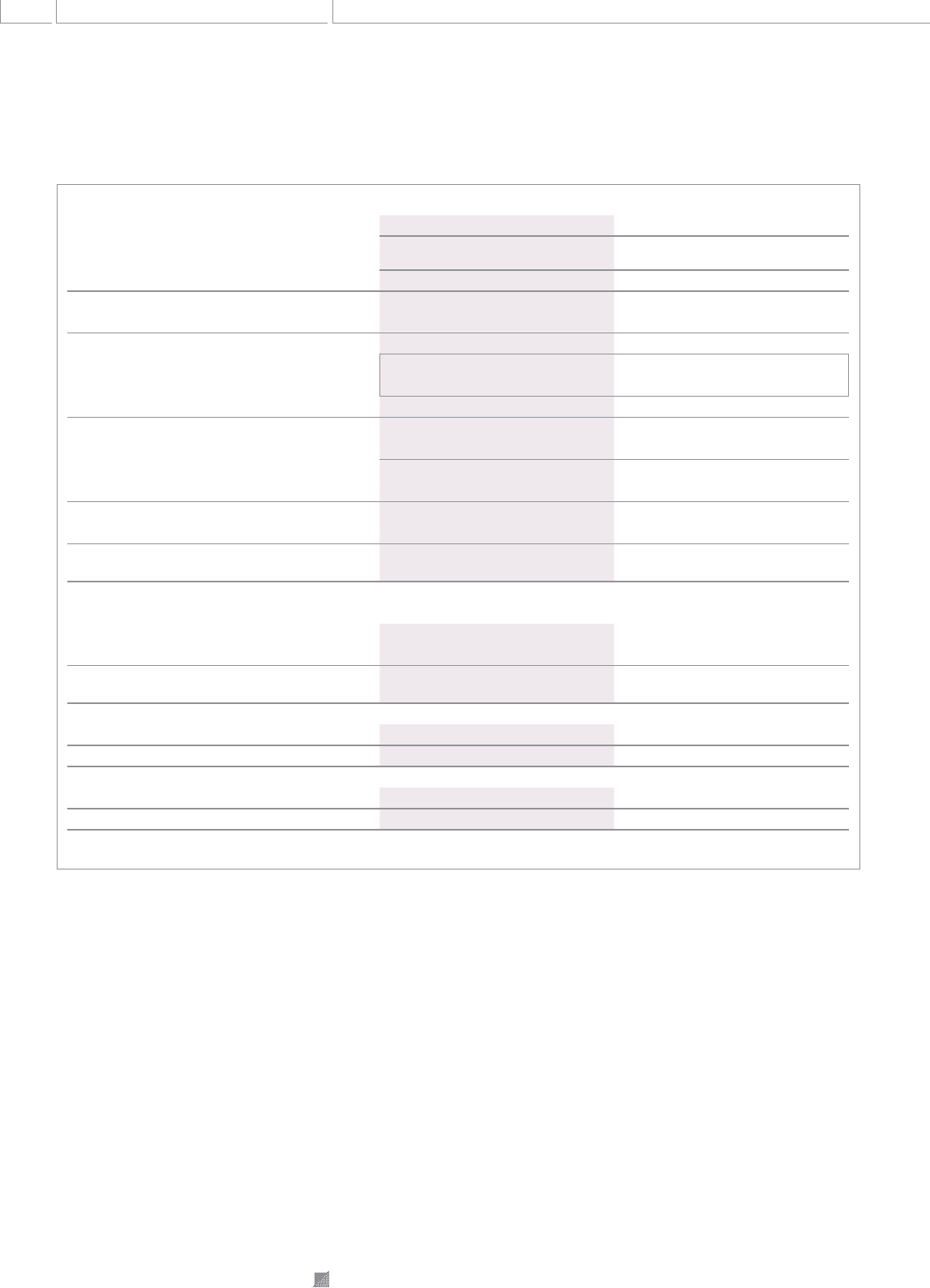

Income statement analysis – continuing operations

2010 2009

Benchmark

Non-

benchmark1Total Benchmark

Non-

benchmark1To t a l

Year ended 31 March US$m US$m US$m US$m US$m US$m

Revenue 3,880 -3,880 3,873 -3,873

Cost of sales (1,889) -(1,889) (1,824) -(1,824)

Gross prot 1,991 -1,991 2,049 -2,049

Distribution costs (419) -(419) (387) -(387)

Administrative expenses (639) (240) (879) (767) (282) (1,049)

Operating expenses (1,058) (240) (1,298) (1,154) (282) (1,436)

Operating prot/(loss) 933 (240) 693 895 (282) 613

Share of prots of associates 58 -58 44 (2) 42

EBIT from continuing operations 991 (240) 751 939 (284) 655

Net nance cost (81) (9) (90) (96) 19 (77)

Prot/(loss) before tax 910 (249) 661 843 (265) 578

Ta x (184) 167 (17) (184) 100 (84)

Prot/(loss) after tax for the year from

continuing operations 726 (82) 644 659 (165) 494

Attributable to:

Owners of Experian plc 681 (73) 608 631 (157) 474

Minority interests 45 (9) 36 28 (8) 20

Prot/(loss) after tax for the year from

continuing operations 726 (82) 644 659 (165) 494

US cents US cents US cents US cents US cents US cents

Earnings/(loss) per share – basic 67.1 (7.3) 59.8 62.3 (15.5) 46.8

%%%% % %

Effective rate of tax 20.2 67.1 2.6 21.8 37.7 14.5

1. These include charges for exceptional items of US$72m (2009: US$117m) and other non-GAAP measures of US$177m (2009: US$146m), full details of

which are included in note 10 to the Group nancial statements.

Financial review (continued)

100