Experian 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

Introduction

2 – 11

Business review

12 – 51

Financial statements

85 – 160

Governance

52 – 84

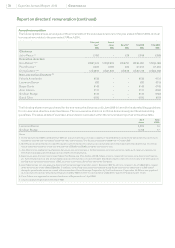

Experian reinvestment plan

Awards to executive directors under the 2004 and 2005 cycles of the GUS co-investment plan and North America co-investment

plan were reinvested in awards under the Experian reinvestment plan and North America reinvestment plan at demerger to

ensure that directors remained fully aligned with the performance of the demerged business. Matching awards of shares

were made under these plans, the release of which is subject to the achievement of performance conditions, the retention of

reinvested shares and continued employment. The vesting of 50% of these awards was subject to achievement against a sliding

scale of growth in PBT performance condition. A threshold level of vesting of 30% of this part of the award was available for

average growth in PBT of 7% per annum over a three-year period, rising on a straight-line basis to 100% of this part of the award

vesting for average PBT growth of 14% per annum. This part of the matching award will vest in two equal tranches on the fourth

and fth anniversaries of grant. The remaining 50% of the matching award vested as to 50% on the third anniversary of grant and

vests as to 25% on each of the fourth and fth anniversaries of grant.

The Committee tested the PBT performance condition, at the end of the performance period, and determined that Experian’s

average annual growth in PBT over the performance period was 13.2% and as a result 92% of the awards subject to this

performance condition will vest on the applicable vesting dates. Details of the number of shares which will be released to the

executive directors are given in the table titled ‘GUS and Experian co-investment plans and Experian reinvestment plans’.

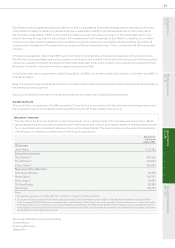

GUS executive share option scheme

Options granted in June 2006 under the GUS executive share option scheme were automatically exchanged for equivalent

options over Experian shares on demerger. Vesting of these options was subject to Experian’s average annual growth in EPS

exceeding the UK Retail Price Index by at least 4% per annum over a three-year performance period. The Committee tested this

performance condition, at the end of the performance period, and determined that it was achieved and so these options vested

in June 2009. Details of the number of shares under option held by the directors are given in the table titled ‘Share options’.

The Committee considers that the outcome of the various performance conditions described above is appropriate given the

overall performance of the Group since demerger.

81

79