Experian 2010 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

141

Introduction

2 – 11

Business review

12 – 51

Governance

52 – 84

Financial statements

85 – 160

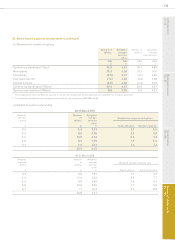

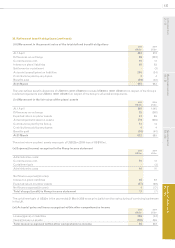

31. Deferred tax (continued)

(c) Deferred tax liabilities

Movements in gross deferred tax liabilities, without taking into consideration the offsetting of liabilities and assets within the

same tax jurisdiction, comprise:

Property

valuations

US$m

Accelerated

depreciation

US$m

Intangibles

US$m

Share option

and award

plans

US$m

Tax losses

US$m

Other

temporary

differences

US$m

To t a l

US$m

At 1 April 2009 - 5 243 - - 142 390

Differences on exchange - 1 32 - - - 33

Income statement charge/(credit) -30 86 - - (106) 10

Business combinations - - 5 - - - 5

Transfer in respect of liabilities held

for sale - - (4) - - - (4)

At 31 March 2010 -36 362 - - 36 434

Property

valuations

US$m

Accelerated

depreciation

US$m

Intangibles

US$m

Share option

and award

plans

US$m

Tax losses

US$m

Other

temporary

differences

US$m

Tot a l

US$m

At 1 April 2008 5 37 184 1 4 176 407

Differences on exchange 8 (2) (48) - - (37) (79)

Income statement charge/(credit) (13) 6 (57) (1) (4) 82 13

Business combinations - - 20 - - - 20

Trans f e r s - (36) 144 - - (79) 29

At 31 March 2009 - 5 243 - - 142 390

Deferred tax liabilities of US$1,447m (2009: US$2,062m) have not been recognised for the withholding tax and other taxes that

would be payable on the unremitted earnings of certain subsidiaries. As the earnings are continually reinvested by the Group, no

tax is expected to be payable on them in the foreseeable future. The decrease in the unrecognised liabilities in the year resulted

from changes in the Group structure.

At the balance sheet date there were deferred tax liabilities expected to reverse within the next year of US$57m (2009: US$94m).