Experian 2010 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Financial statements104

Notes to the Group nancial statements (continued)

5. Financial risk management (continued)

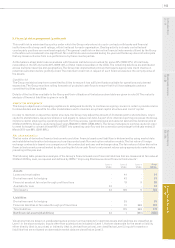

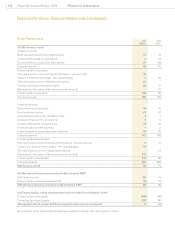

The following table presents an analysis of the changes in Level 3 nancial assets and liabilities for the year ended 31 March 2010

which comprise put and call options associated with corporate transactions:

Financial assets/(liabilities) classied as Level 3 Serasa put

option

US$m

Other

derivatives

US$m

To t a l

US$m

At 1 April 2009 (424) -(424)

Additions in the year -(8) (8)

Valuation gains and losses recognised in income statement (note 11) (113) 9(104)

Currency translation gains and losses recognised in other comprehensive income (124) -(124)

At 31 March 2010 (661) 1(660)

The put option associated with the remaining 30% stake in Serasa is valued at the higher of 95% of the equity value of Serasa

or the value of Serasa based on the P/E ratio of Experian and the latest earnings of Serasa. A Monte Carlo simulation has been

used to calculate the liability. The key assumptions in arriving at the value of the put are the equity value of Serasa, the future

P/E ratio of Experian at the date of exercise, the respective volatilities of Experian and Serasa and the risk free rate in Brazil. It

is also assumed that the put may be exercised in June 2012. Gains and losses in respect of the valuation of the put option since

acquisition in June 2007 have been recorded as nancing fair value remeasurements. Movements in the year ended 31 March 2010

primarily relate to an increase in the equity value of Serasa.

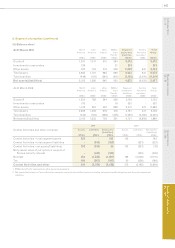

6. Segmental information

Under IFRS 8 'Operating Segments', an operating segment is a component of an entity:

that engages in business activities from which it may earn revenues and incur expenses (including revenues and expenses -

relating to transactions with other components); and

whose operating results are regularly reviewed by the chief operating decision maker to assess its performance and make -

decisions about resources to be allocated to the segment; and

for which discrete nancial information is available. -

Experian is organised into, and managed on a worldwide basis over, the following ve operating segments, based on geographic

areas, supported by its central Group functions:

North America; -

Latin America; -

UK and Ireland; -

Europe, Middle East and Africa (‘EMEA’); and -

Asia Pacic. -

The chief operating decision maker, identied in accordance with the requirements of IFRS 8, assesses the performance of the

above operating segments on the basis of EBIT, as dened in note 4.