Experian 2010 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Financial statements100

Notes to the Group nancial statements (continued)

4. Signicant accounting policies (continued)

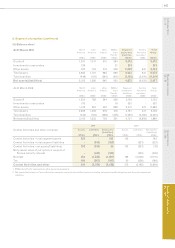

The key assumptions used for value-in-use calculations are: 2010 2009

CGU

Pre-tax

WACC

Long term

growth rate

Pre-tax

WACC

Long term

growth rate

North America 12.2% 2.3% 11.6% 2.3%

Latin America 15.4% 6.4% 17.0% 8.0%

UK & Ireland 10.5% 2.3% 11.5% 2.3%

EMEA 9.8% 4.3% 12.1% 4.3%

Asia Pacic 11.6% 4.8% 13.5% 4.8%

At 31 March 2010, the recoverable amount of the Latin America CGU exceeds the carrying value by approximately US$500m and

an increase in the pre-tax WACC of 2.6% or a reduction of 4.4% in the long-term growth rate would reduce the value-in-use of

its goodwill to an amount equal to its carrying value. At 31 March 2010, the recoverable amount of the Asia Pacic CGU exceeds

the carrying value by approximately US$100m and an increase in the pre-tax WACC of 3.4% or a reduction of 5.8% in the long-

term growth rate would reduce the value-in-use of its goodwill to an amount equal to its carrying value.

Share-based payments

The Group has a number of equity settled share-based employee incentive plans. The assumptions used in determining the

amounts charged in the Group income statement include judgments in respect of performance conditions and length of service

together with future share prices, dividend and interest yields and exercise patterns.

Critical judgments

Management has made certain judgments in the process of applying the Group’s accounting policies set out above that have

a signicant effect on the amounts recognised in the Group nancial statements. The accounting policy descriptions indicate

where judgment needs exercising and these judgments include the classication of transactions between the Group income

statement and the Group balance sheet.

The most signicant of these judgments is in respect of intangible assets where certain costs incurred in the developmental

phase of an internal project are capitalised if a number of criteria are met. Management has made certain judgments and

assumptions when assessing whether a project meets these criteria, and on measuring the costs and the economic life

attributed to such projects. On acquisition, specic intangible assets are identied and recognised separately from goodwill

and then amortised over their estimated useful lives. These include such items as brand names and customer lists, to which

value is rst attributed at the time of acquisition. The capitalisation of these assets and the related amortisation charges are

based on judgments about the value and economic life of such items. The economic lives for intangible assets are estimated

at between three and ten years for internal projects, which include databases, internal use software and internally generated

software, and between two and twenty years for acquisition intangibles.

Use of non-GAAP measures in the Group nancial statements

The Group has identied certain measures that it believes will assist understanding of the performance of the business. The

measures are not dened under IFRS and they may not be directly comparable with other companies’ adjusted measures.

The non-GAAP measures are not intended to be a substitute for, or superior to, any IFRS measures of performance but

management has included them as they consider them to be important comparables and key measures used within the

business for assessing performance.

The following are the key non-GAAP measures identied by the Group:

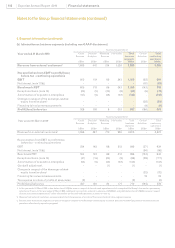

Benchmark prot before tax (‘Benchmark PBT’)

Benchmark PBT is dened as prot before amortisation of acquisition intangibles, goodwill impairments, charges in respect

of the demerger-related equity incentive plans, exceptional items, nancing fair value remeasurements, tax and discontinued

operations. It includes the Group’s share of associates’ pre-tax prot.

Earnings before interest and tax (‘EBIT’)

EBIT is dened as prot before amortisation of acquisition intangibles, goodwill impairments, charges in respect of the

demerger-related equity incentive plans, exceptional items, net nance costs, tax and discontinued operations. It includes the

Group’s share of associates’ pre-tax prot.

Benchmark earnings

Benchmark earnings represents Benchmark PBT less attributable tax and minority interests. Benchmark earnings attributable

to minority interests represents that portion of Benchmark earnings that relate to minority interests. Benchmark PBT less

attributable tax is designated as overall benchmark earnings.

Benchmark earnings per share (‘Benchmark EPS’)

Benchmark EPS represents Benchmark earnings divided by the weighted average number of shares in issue, and is disclosed

to indicate the underlying protability of the Group.