Experian 2010 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Financial statements154

Notes to the parent company nancial statements (continued)

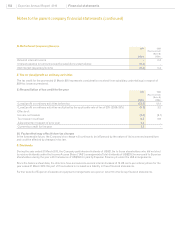

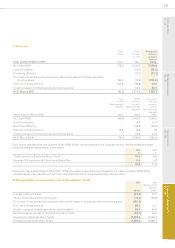

D. Net interest (expense)/income

2010

US$m

2009

(Represented)

(Note B)

US$m

External interest income -0.4

Interest expense on amounts owed by subsidiary undertakings (0.2) -

Net interest (expense)/income (0.2) 0.4

E. Tax on (loss)/prot on ordinary activities

The tax credit for the year ended 31 March 2010 represents consideration received from subsidiary undertakings in respect of

2009 tax losses surrendered.

(i) Reconciliation of tax credit for the year

2010

US$m

2009

(Represented)

(Note B)

US$m

(Loss)/prot on ordinary activities before tax (23.6) 12.4

(Loss)/prot on ordinary activities multiplied by the applicable rate of tax of 25% (2009: 25%) (5.9) 3.2

Effects of:

Income not taxable (0.6) (9.1)

Tax losses not utilised 6.5 5.9

Adjustments in respect of prior year 0.3 -

Current tax credit for the year 0.3 -

(ii) Factors that may affect future tax charges

In the foreseeable future, the Company’s tax charge will continue to be inuenced by the nature of its income and expenditure

and could be affected by changes in tax law.

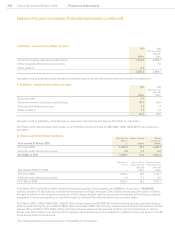

F. Dividends

During the year ended 31 March 2010, the Company paid interim dividends of US$21.0m to those shareholders who did not elect

to receive dividends under the Income Access Share (‘IAS’) arrangements. Total dividends of US$205.7m were paid to Experian

shareholders during the year with the balance of US$184.7m paid by Experian Finance plc under the IAS arrangements.

Since the balance sheet date, the directors have announced a second interim dividend of 16 US cents per ordinary share for the

year ended 31 March 2010. No part of this dividend is included as a liability in these nancial statements.

Further details of Experian dividends and payment arrangements are given in note 15 to the Group nancial statements.