Experian 2010 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Business review16

Key performance indicators

Experian’s strategy is centred on three elements: to focus on data and analytics, drive

protable growth and optimise capital efciency. Our nancial objectives are to drive

organic revenue growth, to maintain or grow EBIT margins and to convert at least 90%

of EBIT into operating cash ow. The following indicators include key metrics used by

the Board and internally to assess Experian’s success in achieving its objectives.

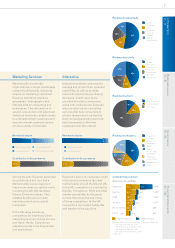

Cash flow (US$) and cash flow

conversion

Experian aims to convert at least 90% of

its EBIT into operating cash ow each

year. In the year ended 31 March 2010, we

exceeded this target converting 98% of

EBIT to operating cash ow.

See pages 40 and 101 for denition of operating

cash ow and cash ow conversion.

For additional information on cash ow see page

90 for the Group cash ow statement.

Organic revenue growth

Organic revenue growth increased by

2% in the year ended 31 March 2010,

with good growth in emerging markets,

such as Latin America, and a solid

performance from more established

markets, notwithstanding the

challenging economic conditions. We

have demonstrated our ability to deliver

organic revenue growth throughout the

business cycle.

See page 45 for denition of organic revenue

growth.

2%

10

3%

09

4%

08

8%

07

12%

06

Percentage of revenue from verticals

other than financial services

Experian aims to diversify beyond

nancial services by expanding into

new market segments including

new B2B verticals, such as public

sector, telecoms and utilities, and

the consumer channel. Experian now

generates more than 60% of revenue

from outside nancial services.

98%

10 976

99%

09 927

98%

08 886

97%

07 804

99%

06 717

64%

10

48%

08

59%

09

47%

07

45%

06

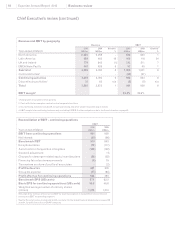

EBIT (US$) and margin

In the year ended 31 March 2010,

Experian increased its total EBIT at

constant exchange rates by 6% to

US$991m. Continuing EBIT increased

by 6% at constant exchange rates.

We again met our margin objective,

with an 80 basis point expansion in the

EBIT margin from continuing activities

to 24.4%. This was achieved while

continuing to invest organically in future

growth initiatives.

Total revenue growth

In the year ended 31 March 2010,

Experian increased its total revenue

from continuing activities by 2% at

constant exchange rates. Total revenue

improved by US$69m.

See page 45 for denition of total revenue growth.

For further information on revenue split by

operating and business segment, see note 6 in the

Group nancial statements.

Organic growth Acquired growth

EBIT includes discontinuing activities. EBIT

margin is for continuing direct business only,

excluding FARES.

24.4%

10 991

23.6%

22.8%

21.9%

21.0%

09 939

08 908

07 825

06 727

10 2%

14%

14%

08

07

8%

09

Revenue dependence on

top 20 clients

Experian aims to reduce its reliance

on any single client and to increase

the balance and diversity of its

revenue base.

In the year ended 31 March 2010, we

made progress against this objective

with further reduction in revenue

dependency on our top 20 clients.

17%10

18%09

18%08

21%07

06 22%

06 30%