Experian 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Governance82

Report on directors’ remuneration (continued)

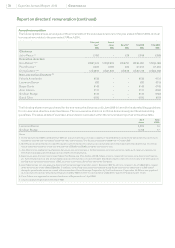

Executive directors’ annual pension

Don Robert is provided with benets through a Supplementary Executive Retirement Plan (‘SERP’) which is a dened benet

arrangement in the US. The gures below are in respect of his SERP entitlement. He is also entitled to participate in the US

dened contribution arrangement (401k Plan). The employer contributions to this arrangement during the year were nil (2009:

US$8,507).

Paul Brooks is a member of the registered Experian UK pension scheme. His benets are restricted by an earnings cap.

However, benets in excess of this cap are provided for through the Experian Limited SURBS. The pension gures below

reect both his registered and non-registered entitlement.

Chris Callero is a participant in the US dened contribution arrangement (401k Plan) and during the year the employer

contributions to this arrangement were nil (2009: US$11,553).

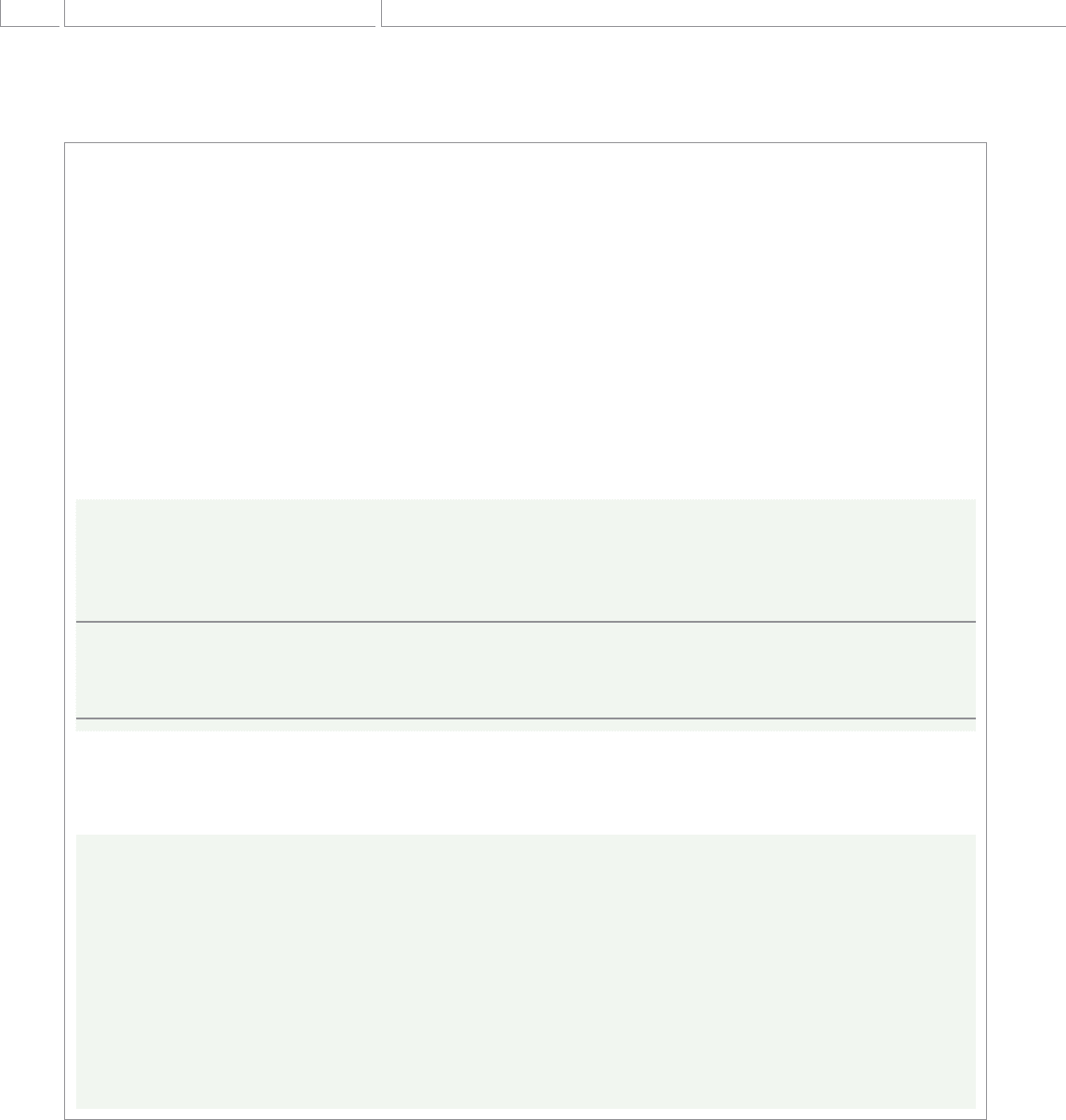

The table below provides the disclosure of the above directors’ pension entitlements in respect of benets from registered and

non-registered dened benet schemes and arrangements.

Accrued

pension at

31 March

2010

per annum

(1)

US$’000 pa

Accrued

pension at

31 March

2009

per annum

(2)

US$’000 pa

Transfe r

value at

31 March

2010

(3)

US$’000

Transfe r

value at

31 March

2009

(4)

US$’000

Change in

transfer

value (less

director’s

contributions)

(5)

US$’000

Additional

pension earned

to 31 March 2010

(net of ination)

per annum

(6)

US$’000 pa

Transfer value

of the increase

(less director’s

contributions)

(7)

US$’000

Don Robert 432 376 6,802 6,503 317 56 882

£’000 pa £’000 pa £’000 £’000 £’000 £’000 pa £’000

Paul Brooks 166 132 3,306 2,181 1,116 34 671

Five former directors of Experian Finance plc (formerly GUS plc) receive unfunded pensions from the Company. Four of the

former directors are paid under the SURBS. The total unfunded pensions paid to the former directors was £600,330 (2009:

£566,734).

Notes:

Columns (1) and (2) represent the deferred pension to which the director would have been entitled had he left the Group at 31 March 2010 and 2009

respectively.

Column (3) is the transfer value of the pension in column (1) calculated as at 31 March 2010 based on factors supplied by the actuary of the relevant Group

pension scheme in accordance with version 8.1 of the UK actuarial guidance note GN11.

Column (4) is the equivalent transfer value, but calculated as at 31 March 2009 on the assumption that the director left service at that date.

Column (5) is the change in transfer value of accrued pension during the year net of contributions by the director.

Column (6) is the increase in pension built up during the year, recognising (i) the accrual rate for the additional service based on the pensionable salary in

force at the year end, and (ii) where appropriate the effect of pay changes in “real” (ination adjusted) terms on the pension already earned at the start of the

year.

Column (7) represents the transfer value of the pension in column (6).

The disclosures in columns (1) to (5) are equivalent to those required by the Large and Medium-sized Companies and Groups (Accounts and Reports)

Regulations 2008 and those in columns (6) and (7) are those required by the UK Financial Services Authority’s Listing Rules.

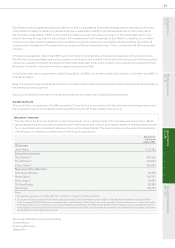

Executive directors’ service contracts

Don Robert has a service agreement with Experian Services Corporation (‘ESC’) dated 7 August 2006. This provides that, if

his employment is terminated by ESC without cause, he is entitled to the following severance payments: continued payment of

monthly salary for 12 months from the termination date; 12 months’ participation in welfare benet plans in which he participated

during his employment; and an annual bonus based on a 100% achievement of objectives payable in equal monthly instalments

for 12 months. The same amounts are payable by ESC if Don Robert terminates the contract: (i) following material breach by

ESC; or (ii) for Good Reason following a change of control of ESC. Good Reason means, during the six month period following a

change of control, a material and substantial adverse reduction or change in Don Robert’s position. These terms are in line with

US practice.