Experian 2010 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Business review12

Key trends

As we move forward, we see a number

of trends which will inuence our

performance over the coming year.

Within nancial services, we see •

gradual recovery across many of

the developed markets in which we

operate. In key territories such as

North America, unemployment rates

have started to level off, delinquency

rates are starting to fall, lenders are

beginning to solicit new customers

and small businesses are starting

to look for funding to expand.

Experian has a key role to play in

this recovery process, helping to

restore condence in the global retail

banking system with our world-class

data, analytics and software tools.

Across the retail sector, we see •

consumer spending driving

improvement among retailers.

We also see a steady shift to more

targeted digital advertising channels

and we are increasing our efforts

to benet from this trend as client

marketing budgets return.

And at Consumer Direct in North •

America, the new marketing strategy

for freecreditscore.com implemented

from 1 April 2010 is progressing in

line with expectations. We have had

recent dialogue with the Federal

Trade Commission regarding our

site, freecreditreport.com, and we

have made further changes to this

site through the addition of consumer

disclosures. We remain vigilant

regarding any regulatory changes

that may affect our business and will

adapt as needed.

Strategic priorities

While global economic recovery

will help our business, our goal is to

accelerate growth by creating new

market opportunities, building greater

scale and further cementing our global

leadership position. Each year, we

develop specic plans which set our

priorities and allow us to concentrate

our resources. These plans are

executed within our strategic framework

to focus on data and analytics, drive

protable growth and optimise capital

efciency. Our action plan is centred

on taking control of growth through a

series of dened initiatives:

Expanding our global reach

Geographic expansion – we see •

signicant scope to take our existing

credit and marketing products into

fast-growing markets, for example

Brazil, India, China, South Africa and

Eastern Europe.

Vertical expansion – we are further •

repurposing our data and platforms

to build scale positions in new

verticals such as the public sector,

telecoms, utilities and US healthcare

payments.

New market channels – we see •

opportunity to further expand in

underpenetrated segments, such as

small and medium enterprises.

Chief Executive’s review

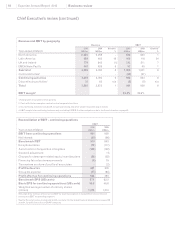

This meant that we ended the year

comfortably within our target gearing

range, at 1.8x adjusted net debt to

EBITDA, including the current value

of the Serasa put option. The strength

of this performance has enabled us

again to raise our full-year dividend,

which is up 15% to 23.00 US cents per

ordinary share.

We were able to deliver this strong

performance because of the balance

in our portfolio, the strength of our

market position and strong execution

against our cost efciency programme.

We were especially pleased with the

outstanding performances across

Latin America and at Interactive, which

helped to offset the drag effect of the

global economic recession.

Progress in the year included:

strong growth in emerging markets, •

which now account for nearly one

fth of our revenue;

an increased contribution from •

non-nancial B2B verticals and the

consumer channel. We now generate

more than 60% of our revenue from

outside nancial services;

a strong contribution from products •

developed in the past ve years,

which again accounted for over 20%

of Group revenue; and

our cost efciency programme, which •

delivered savings ahead of plan.

Don Robert

Chief Executive

Experian performed well in 2010, notwithstanding

the challenges presented by the global economic

downturn. Our organic revenue growth was 2%, we

expanded our margins by 80 basis points to 24.4% and

our Benchmark EPS grew by 8% to 67.1 US cents per

ordinary share. We also delivered another strong cash

performance with free cash ow of US$818m, up 11%.

8