Experian 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

Introduction

2 – 11

Business review

12 – 51

Governance

52 – 84

Financial statements

85 – 160

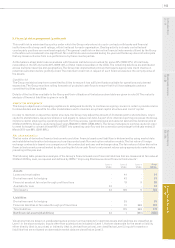

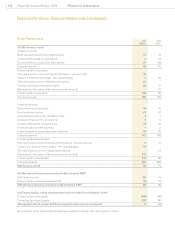

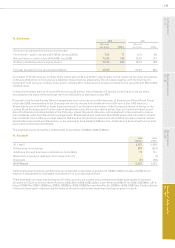

7. Foreign currency

The principal exchange rates used in these nancial statements are as follows:

Average Closing

2010 2009 2010 2009 2008

Sterling : US dollar 1.58 1.69 1.52 1.43 1.99

US dollar : Brazilian real 1.88 1.96 1.79 2.30 1.75

Euro : US dollar 1.41 1.41 1.35 1.33 1.58

Assets and liabilities of undertakings whose functional currency is not the US dollar are translated into US dollars at the

exchange rates ruling at the balance sheet date. Their income statements are translated into US dollars at average exchange

rates (unless these averages are not a reasonable approximation of the cumulative effect of the rates prevailing on the

transaction dates, in which case income and expenses are translated at the rates on the dates of the transactions). An indication

of the sensitivity of the Group’s results to foreign exchange risk is given in note 5.

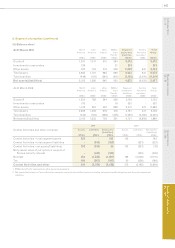

8. Prot before tax

Prot before tax is stated after charging:

(i) Expenses by nature 2010

US$m

2009

US$m

Net operating lease rental expense 51 59

Depreciation of property, plant and equipment 85 90

Amortisation of intangible assets 329 330

Write down on disposal of property, plant and equipment and intangibles 3 1

Other losses on disposal of property, plant and equipment and intangibles 1 -

Employee benet costs (note 9) 1,430 1,428

Amortisation of intangible assets is charged to administrative expenses, except for the amortisation of databases which is

charged to cost of sales.

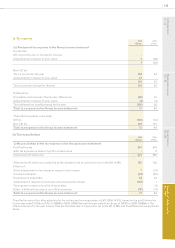

(ii) Fees payable to the Company’s auditor 2010

US$m

2009

US$m

Audit and assurance services:

Audit of the parent company and Group nancial statements 1 1

Audit of the nancial statements of the Group’s subsidiaries, pursuant to legislation 3 3

Other assurance services, including the review of the Group’s half-yearly nancial report 1 1

5 5

Other services:

Taxation services 4 5

Services in respect of the demerger - 4

4 9

Total fees payable to the Company’s auditor and its associates 9 14

The guidelines covering the use of the Company’s auditor for non-audit services are set out in the corporate governance

statement.