Experian 2010 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Financial statements122

Notes to the Group nancial statements (continued)

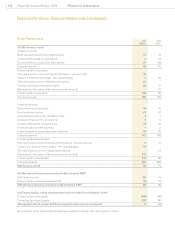

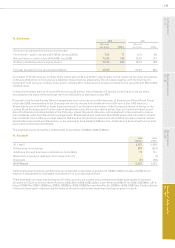

19. Investments in associates

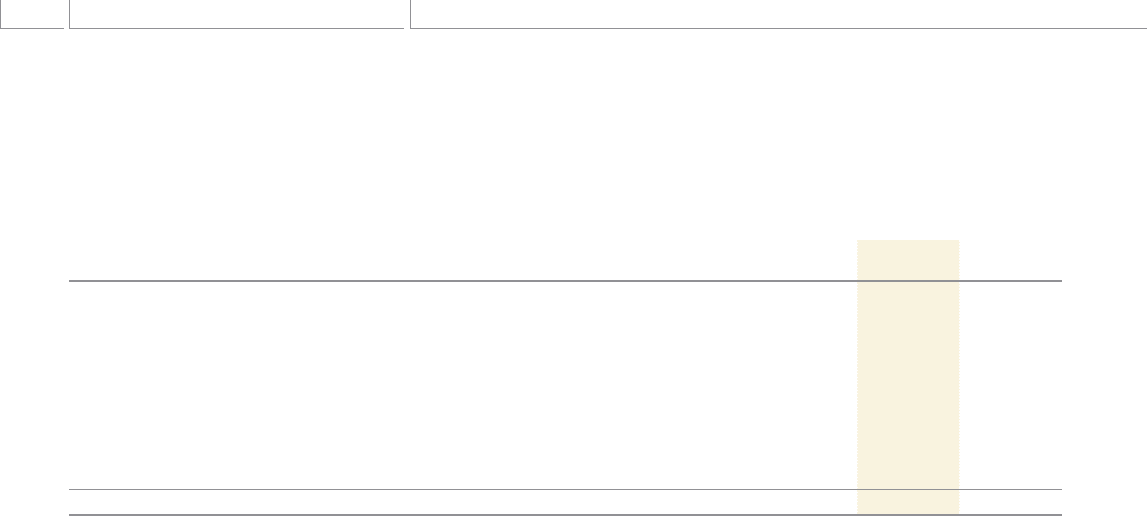

2010

US$m

2009

US$m

Cost

At 1 April 332 295

Differences on exchange (1) (1)

Additions 729

Share of prot after tax 58 42

Dividends received (41) (28)

Disposal of assets by FARES (112) -

Write-down of investment in Japan -(5)

At 31 March 243 332

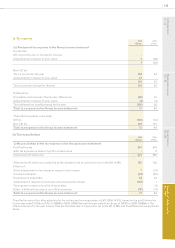

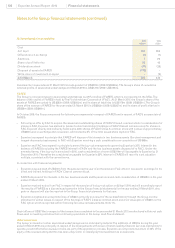

Investments in associates at 31 March 2010 include goodwill of US$237m (2009: US$224m). The Group’s share of cumulative

retained prots of associated undertakings at 31 March 2010 is US$172m (2009: US$155m).

FARES

The Group’s principal interest in associated undertakings is a 20% holding of FARES, which is incorporated in the USA. The

balance of the capital of FARES is held by The First American Corporation (‘FAC’). At 31 March 2010, the Group’s share of the

assets of FARES amounted to US$383m (2009: US$500m) and its share of liabilities is US$176m (2009: US$202m). The Group’s

share of the revenue of FARES for the year ended 31 March 2010 is US$263m (2009: US$237m) and its share of prot after tax is

US$56m (2009: US$46m).

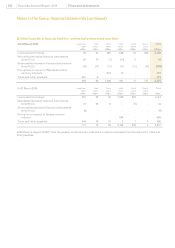

In October 2009, the Group announced the following arrangements in respect of FARES and in respect of FADV, an associate of

FARES:

Following an offer by FAC to acquire the issued and outstanding shares of FADV Class A common stock in consideration for -

shares in FAC, Experian has elected to tender its direct and indirect holdings in FADV Class A common stock for shares in

FAC. Experian directly and indirectly holds some 3.8m shares of FADV Class A common stock with a value of approximately

US$69m and, on exchange and conversion, will hold some 2% of the total issued share capital of FAC.

Experian has agreed in principle that FARES will dispose of its interests in two business assets (the plant management and -

imaged documents businesses) to FAC with Experian receiving a cash consideration on completion of US$48m.

Experian and FAC have agreed in principle to amend the buy-out arrangements governing Experian’s 20% interest in the -

balance of FARES (excluding the FARES interest in FADV and the two business assets disposed of to FAC). Under the

amended terms, if the buy-out is exercised in 2010, cash consideration of some US$314m will be payable to Experian by 31

December 2010. Thereafter the consideration payable for Experian’s 20% interest in FARES will revert to a set valuation

multiple, consistent with the current terms.

In connection with these arrangements:

Experian received cash of US$70m from the sale during the year of all the shares in FAC which it received in exchange for its -

direct and indirect holdings in FADV Class A common stock.

FARES disposed of its interests in the two business assets and Experian received cash consideration of US$48m in the year -

ended 31 March 2010.

Experian received notice from FAC in respect of the exercise of its buy-out option on 22 April 2010 and will accordingly report -

the results of FARES as a discontinued operation in the Group nancial statements for the year ending 31 March 2011. Any

gain on disposal will also be reported in the Group nancial statements for that year.

Experian recognised an exceptional loss of US$4m primarily as a result of the reclassication through the Group income -

statement of earlier losses in respect of the holdings of FADV Class A common stock and a fair value gain of US$9m on the

FAC option which is reported within nancing fair value remeasurements (note 11).

Cash inows of US$118m in respect of the transactions completed in the year ended 31 March 2010 are disclosed within net cash

ows used in investing activities from continuing operations in the Group cash ow statement.

Other associates

The Group's interests in other associated undertakings are not individually material. The additions of US$7m during the year

ended 31 March 2010 are principally in respect of the arrangements with seven of India’s leading nancial services institutions to

operate a credit information bureau in India. As part of the application process, Experian can only hold a maximum of 49% of the

equity of the licensed entity and this has been a key factor in classifying this investment as an associate.