Experian 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

Introduction

2 – 11

Business review

12 – 51

Governance

52 – 84

Financial statements

85 – 160

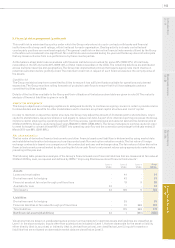

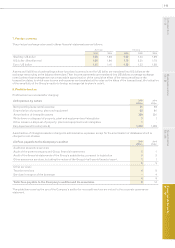

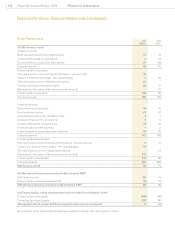

6. Segmental information (continued)

The ‘All other segments’ category required to be disclosed under IFRS 8 has been captioned in these nancial statements

as EMEA/Asia Pacic. This combines information in respect of the EMEA and the Asia Pacic segments as, on the basis of

their share of the Group’s results and net assets, neither of these operating segments is individually reportable under IFRS 8.

Accordingly the information given in respect of this category is comparable to that previously disclosed under IAS 14 in respect

of EMEA/Asia Pacic.

Experian separately presents information equivalent to segment disclosures in respect of the costs of its central Group

functions under the caption of ‘Central Activities’, as management believes that the reporting of this information is helpful to

users of the nancial statements. Information disclosed under Central Activities includes costs arising from nance, treasury

and other global functions.

Inter-segment transactions are entered into under the normal commercial terms and conditions that would also be available to

unrelated third parties. There is no material impact from inter-segment transactions on the Group’s results.

Segment assets consist primarily of property, plant and equipment, intangible assets including goodwill, inventories, derivatives

designated as hedges of future commercial transactions, and receivables. They exclude tax assets, cash, investments and

derivatives designated as hedges of borrowings.

Segment liabilities comprise operating liabilities including derivatives designated as hedges of future commercial transactions.

They exclude tax liabilities, borrowings and related hedging derivatives.

Capital expenditure comprises additions to property, plant and equipment and intangible assets, excluding additions resulting

from acquisitions through business combinations.

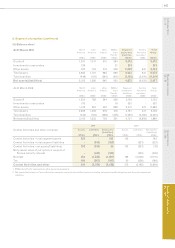

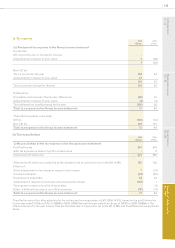

Information presented to meet the requirements of IFRS 8 additionally includes analysis of the Group’s revenues over groups of

service lines. This is supplemented by additional voluntary disclosure of the protability of those same groups of service lines,

and is equivalent to disclosures previously provided of segmental information analysed by business segment under IAS 14. For

ease of reference, Experian continues to use the term ‘business segments’ when discussing the results of groups of service lines

and the four business segments for Experian are:

Credit Services; -

Decision Analytics; -

Marketing Services; and -

Interactive. -

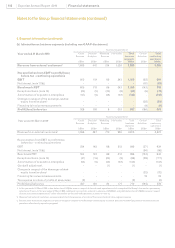

Credit Services acquires, processes and manages large and complex databases containing the credit histories of consumers

and businesses.

Decision Analytics builds on the Credit Services database information and helps clients by applying analytical tools and

software to convert data held internally and other data into usable business information.

Marketing Services helps clients to acquire new customers and to manage their relationships with existing customers. By

appending hundreds of characteristics to the credit and marketing data held in databases, Marketing Services provides

clients with information designed to assist them in matching the right offer or product to the relevant customer using the most

appropriate communication channels.

Interactive helps customers to understand and manage their own nancial information and assets as well as to make more

informed purchasing decisions in areas such as nancial services, shopping and education and to connect them with companies

over the internet.

The North America and the UK and Ireland operating segments derive revenues from all of the Group’s business segments. The

Latin America, EMEA and Asia Pacic segments currently do not derive revenue from the Interactive business segment.

Segment information for the full year provided to the chief operating decision maker, and reportable under IFRS 8, is set out in

section (a) below: