Experian 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

137

Introduction

2 – 11

Business review

12 – 51

Governance

52 – 84

Financial statements

85 – 160

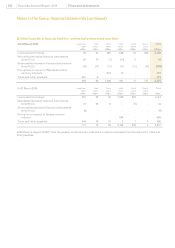

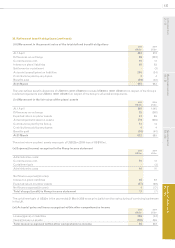

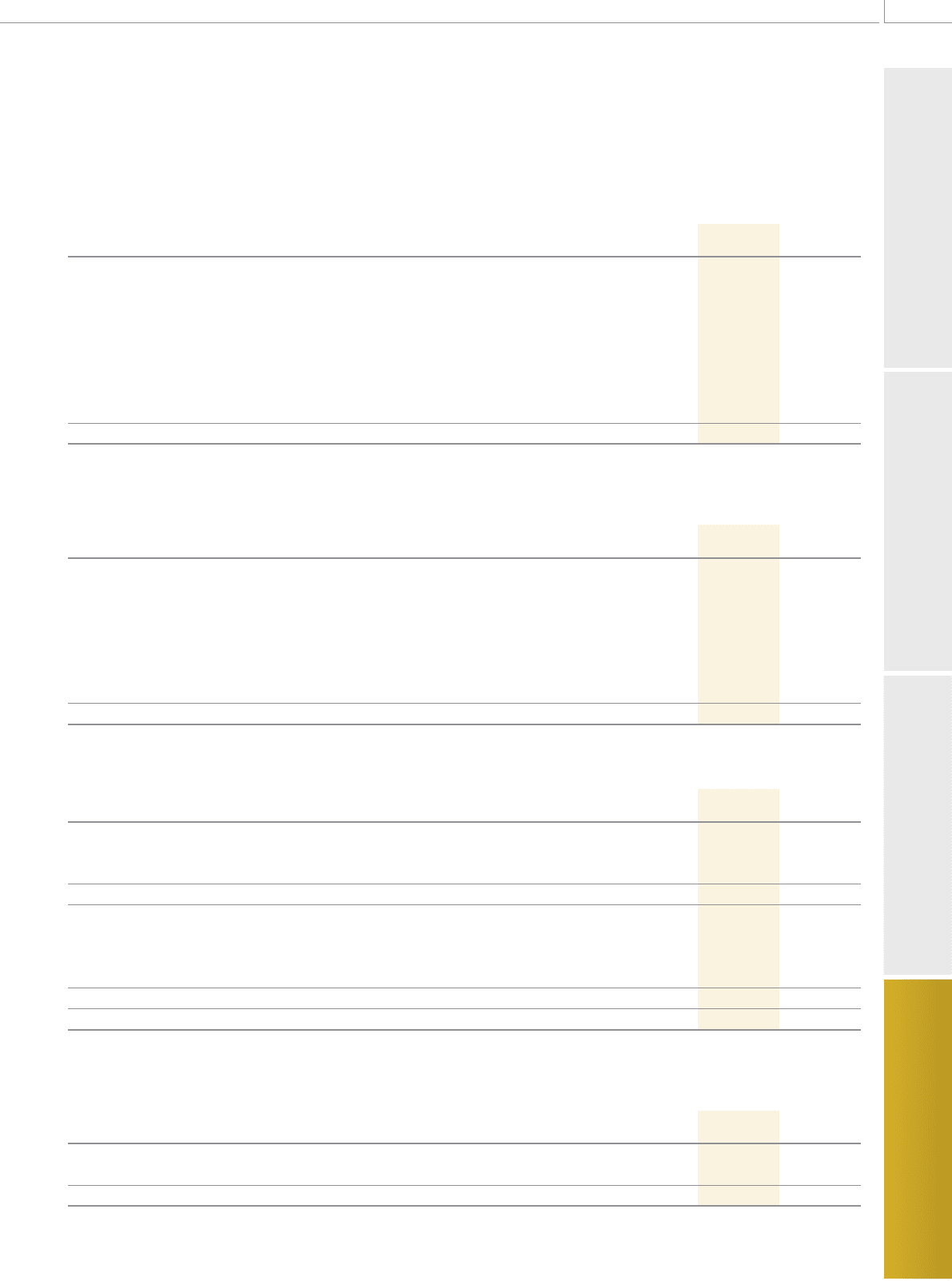

30. Retirement benet obligations (continued)

(iii) Movement in the present value of the total dened benet obligations

2010

US$m

2009

US$m

At 1 April 653 913

Differences on exchange 28 (252)

Current service cost 10 13

Interest on plans’ liabilities 48 52

Settlement or curtailment - (3)

Actuarial losses/(gains) on liabilities 206 (34)

Contributions paid by employees 4 4

Benets paid (39) (40)

At 31 March 910 653

The total dened benet obligations of US$910m (2009: US$653m) include US$860m (2009: US$614m) in respect of the Group’s

funded arrangements and US$50m (2009: US$39m) in respect of the Group’s unfunded arrangements.

(iv) Movement in the fair value of the plans’ assets

2010

US$m

2009

US$m

At 1 April 595 1,045

Differences on exchange 25 (261)

Expected return on plans’ assets 47 69

Actuarial gains/(losses) on assets 178 (236)

Contributions paid by the Group 12 14

Contributions paid by employees 4 4

Benets paid (39) (40)

At 31 March 822 595

The actual return on plans’ assets was a gain of US$225m (2009: loss of US$167m).

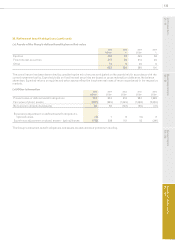

(v) Expense/(income) recognised in the Group income statement

2010

US$m

2009

US$m

Administrative costs:

Current service cost 10 13

Curtailment gain - (3)

Administrative costs 10 10

Net nance expense/(income):

Interest on plans’ liabilities 48 52

Expected return on plans’ assets (47) (69)

Net nance expense/(income) 1 (17)

Total charge/(credit) to Group income statement 11 (7)

The curtailment gain of US$3m in the year ended 31 March 2009 arose principally from the restructuring of continuing businesses

in the UK.

(vi) Actuarial gains and losses recognised within other comprehensive income

2010

US$m

2009

US$m

Losses/(gains) on liabilities 206 (34)

(Gains)/losses on assets (178) 236

Total losses recognised within other comprehensive income 28 202