Experian 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Governance72

2009/10 bonus

The Remuneration Committee set stretching targets for the annual bonus in 2009/10 which required broadly upper quartile

levels of performance in order for maximum bonus to be earned. In what continued to be an extremely challenging business

environment for both Experian and our clients, the performance of the Group exceeded the stretching performance targets

set by the Committee. In the light of this excellent achievement, in uncertain and testing market conditions, maximum bonus is

payable to the executive directors in respect of 2009/10.

The executive directors have all elected to defer 100% of their bonus earned in respect of the 2009/10 nancial year into the CIP.

For this year, the Committee has determined that matching shares will be awarded on a 2:1 basis. It is intended that the release of

50% of the matching share awards will be subject to the achievement of a growth in PBT performance condition and will vest as

shown in the table below. The Committee considers growth in PBT to be an appropriate measure as this represents one of the

key drivers of the business and is aligned with Experian’s core growth strategy.

In order to broaden the success factors against which long-term performance is assessed, it is intended that the other 50% of

the matching share awards will vest subject to the achievement of a stretching three-year cumulative operating cash ow target.

This target has been calibrated to be similarly stretching as the growth in PBT ranges shown above and is based on a cash

conversion rate of at least 90% on average, representing what is expected by the Committee to be broadly equivalent to upper

quartile performance. The Committee considers cumulative operating cash ow to be an appropriate measure as it is a key

metric for the business, particularly in the more challenging economic climate.

2010/11 bonus

It is intended that annual bonus arrangements and the operation of the CIP for executive directors will remain unchanged

for the 2010/11 nancial year. The nal performance conditions and targets for matching shares awarded under the CIP will

be determined shortly before the awards are made in June 2011 and will be disclosed at the appropriate time. However, the

Committee undertakes to ensure that any targets, whilst they must be seen as achievable to retain and motivate executives

during the deferral period, must be sufciently stretching to deliver signicant shareholder value.

Experian performance share plan (‘Experian PSP’)

The Experian PSP was approved by GUS plc shareholders at the Extraordinary General Meeting (‘EGM’) held on 29 August 2006.

Performance shares are Experian shares for which no exercise price is payable. Shares are allocated subject to performance

conditions, which are measured over a three-year performance period, with any vesting occurring three years from the date of

grant. Performance conditions for awards under the Experian PSP will be determined by the Committee in advance of grant.

Dividend equivalents accrue on these awards.

2009/10 Experian PSP awards

Details of Experian PSP awards made to executive directors in June 2009 are given in the table titled ‘Performance share plans’.

75% of these awards are subject to a growth in PBT performance condition measured over a three-year period as shown in the

table below. The Committee considers growth in PBT to be an appropriate measure as this represents one of the key drivers of

the business and is aligned with Experian’s core growth strategy.

Report on directors’ remuneration (continued)

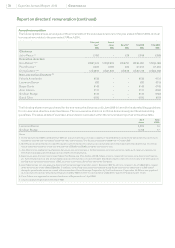

Average annual growth in PBT over three years Percentage of award vesting

Less than 5% 0%

5% 25%

11%* 100%

Between 5% and 11% Between 25% and 100% pro rata

* This level of growth in PBT is expected by the Committee to be broadly equivalent to upper quartile performance

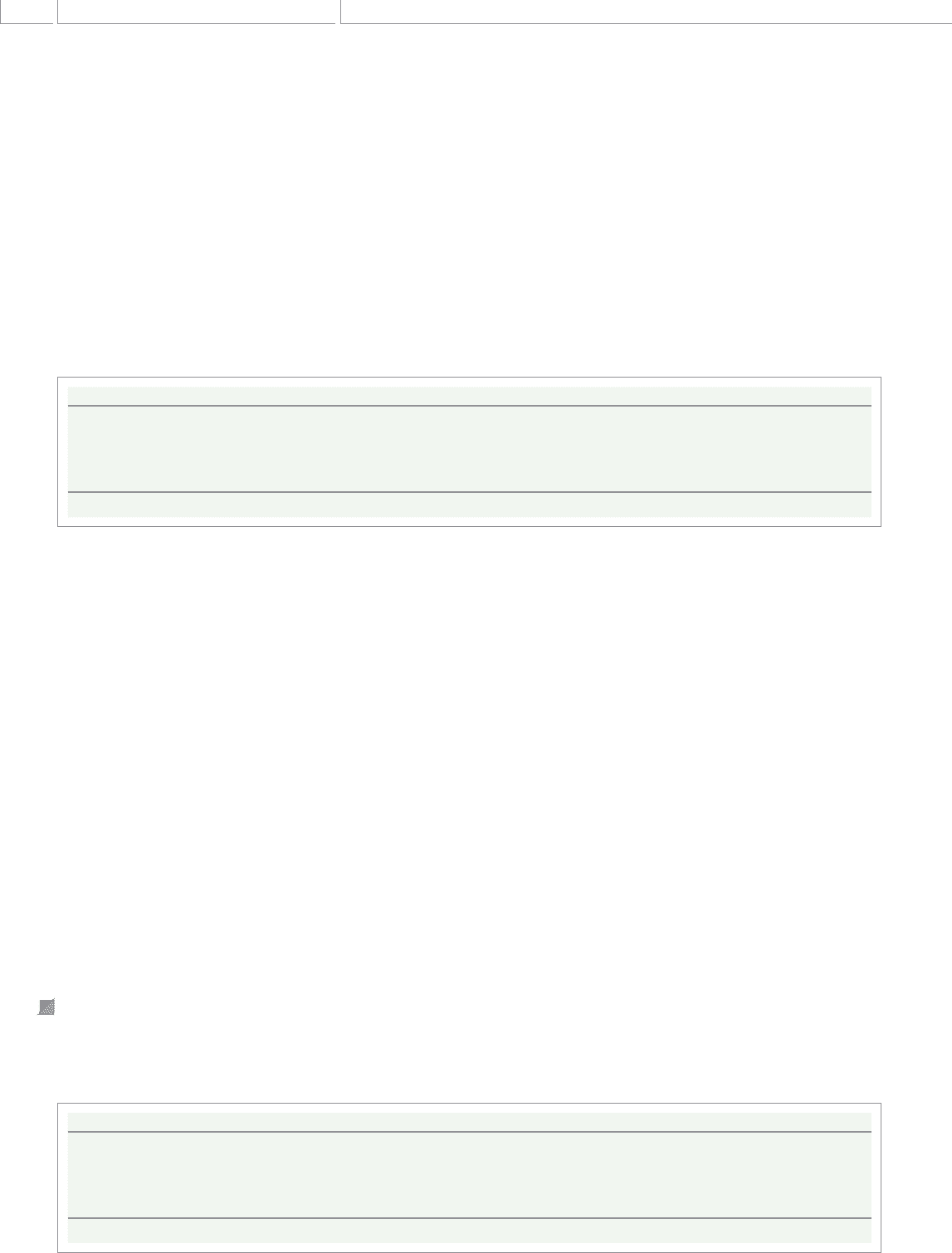

Average annual growth in PBT over three years Percentage of award vesting

Less than 4% 0%

4% 25%

8%* 100%

Between 4% and 8% Between 25% and 100% pro rata

* This level of growth in PBT was expected by the Committee to be broadly equivalent to upper quartile performance, at the time of grant

80