Experian 2010 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

Business review

12 – 51

Governance

52 – 84

Financial statements

85 – 160

Introduction

2 – 11

Full-year

dividend

US 23.0c

Basic EPS

US 59.0c

in this region. We are also investing

in ground-breaking new products,

like ProtectMyID.com, which alerts

consumers to changes in their credit

les and to other activity that might

indicate identity fraud.

Product innovation is a key driver of

growth for Experian in all our markets

and we have continued to invest

strongly in new data sources and

new analytical products, together

with the platforms that support their

worldwide delivery. Over 20% of

Group revenues come from products

developed during just the past

ve years.

Capital strategy

Good capital stewardship is a

cornerstone of Experian’s strategy

and the Board devotes a great deal of

time to ensuring a prudent balance

between investing in the future of the

business and returning surplus cash

to shareholders. Experian is fortunate

in generating more cash than most

businesses our size and this position

has been greatly strengthened by the

continuing successful growth of the

Group. After careful consideration,

the Board has decided to enhance

Experian’s current distribution

strategy. We are introducing a share

buyback programme and intend to

increase our dividend payout ratio

over the next 12 months.

Board

Since the year-end, Experian’s board

has been further strengthened by

the appointment of Judith Sprieser

and Paul Walker as non-executive

directors. Both have extensive

boardroom experience, as well as

a broad perspective of the global

technology and software industries,

which will be a great asset to

Experian as we continue to extend

our worldwide reach.

Corporate responsibility

Corporate responsibility remains

a high priority for the Board and

we again set targets for enhancing

Experian’s contribution to society

and reducing our impact on the

environment.

In many ways, Experian is already a

force for good through the support

we provide to clients; helping to

ensure responsible access to credit,

reducing fraud and improving

business efciency. But we are

also encouraging the application

of our skills and services to tackle

important social issues. One

initiative, supporting micronance

amongst communities without

access to traditional banking

services, has come to fruition this

year and another, addressing ethnic

diversity in the workplace, is under

development.

As the business grows, our

community programme is continuing

to keep pace. Experian’s total

community contribution this year

was up 13%, as the result of increases

in employee volunteering and pro

bono work for charitable projects. In

many of our major markets, such as

Brazil, North America and the UK,

employees are taking part in some

excellent volunteer programmes to

help vulnerable communities improve

their nancial literacy.

Summary

This has been another challenging

year for many parts of the Group, but

we have continued to grow protably,

while investing in our business. As

we emerge from the global economic

downturn, we can take pride in the

fact that, throughout the downturn,

Experian has never stopped growing.

It is a tremendous achievement that

has called for strong management,

great teamwork and a supreme effort

on the part of all our people.

Right now we are focused on the

year ahead and on the opportunities

that will enable us to accelerate this

growth. Experian is in good shape

and we are looking to the future

with condence.

John Peace

Chairman

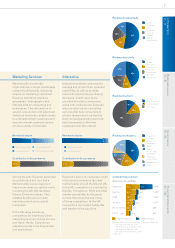

Dividends per share up 15%

Benchmark earnings per

share up 8% to US67.1c and

basic EPS of US59.0c,

up 23%

Basic earnings per share (US cents) Dividend (US cents)

10 59.0

08 43.3

09 48.0

10 23.0

08 18.5

09 20.0

52

53

8

48