Experian 2010 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

159

Introduction

2 – 11

Business review

12 – 51

Governance

52 – 84

Financial statements

85 – 160

Shareholder information

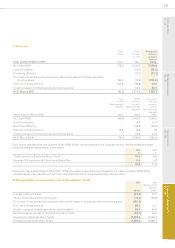

Analysis of ordinary shareholdings

Shareholdings Ordinary shares

By size of shareholding Number %Number %

Over 1,000,000 142 0.4 823,469,895 80.2

100,001 - 1,000,000 377 1.0 133,115,432 13.0

10,001 - 100,000 883 2.4 26,765,736 2.6

5,001 - 10,000 1,158 3.1 7,896,453 0.8

2,001 - 5,000 4,677 12.7 14,233,900 1.4

1 - 2,000 29,666 80.4 20,593,265 2.0

To t a l 36,903 100.0 1,026,074,681 100.0

Shareholdings Ordinary shares

By nature of shareholding Number %Number %

Corporates 8,741 23.7 986,655,843 96.2

Individuals 28,162 76.3 39,418,838 3.8

To t a l 36,903 100.0 1,026,074,681 100.0

Experian website

A full range of investor information is available at www.experianplc.com. Details of the 2010 annual general meeting (‘AGM’),

to be held at The Merrion Hotel, Upper Merrion Street, Dublin 2, Ireland at 9.30am on Wednesday 21 July 2010, are given on the

website and in the notice of meeting.

Electronic shareholder communication

Shareholders may register for Shareview, an electronic communication service provided by Equiniti Limited on behalf of the

Company’s Registrars, Equiniti (Jersey) Limited. Registration is via the website, www.experianplc.com, or direct at www.

experianshareview.com.

The service enables shareholders to access a comprehensive range of shareholder services online, including dividend payment

information, the ability to check shareholdings, amend address or bank details and submit AGM proxy voting instructions.

When registering for Shareview, shareholders can select their preferred communication method - email or post. All

shareholders will receive a written notication of the availability on the Company’s website of shareholder documents, such

as the annual report unless they have elected to either (i) receive such notication via email or (ii) receive paper copies of

shareholder documents where such documents are available in that format.

Dividend Reinvestment Plan (‘DRIP’)

The DRIP enables those shareholders who receive their dividends under the IAS election arrangements to use their cash

dividends to purchase Experian shares. Such shareholders who wish to participate in the DRIP for the rst time, in respect of the

second interim dividend for the year ended 31 March 2010 to be paid on 23 July 2010, should return a completed and signed DRIP

mandate form to be received by the Registrars, by no later than 25 June 2010. For further details please contact the Registrars.

Capital Gains Tax (‘CGT’) base cost for UK shareholders

On 10 October 2006, GUS plc separated its Experian business from its Home Retail Group business by way of demerger.

Following the demerger, GUS plc shareholders at 4.30pm on 6 October 2006 were entitled to receive one share in Experian plc and

one share in Home Retail Group plc for every share they held in GUS plc at that time.

The previous base cost of any GUS plc shares held at 4.30pm on 6 October 2006 is apportioned for UK CGT purposes in the

following ratio: 58.235% to Experian plc shares and 41.765% to Home Retail Group plc shares (based on the closing prices of

the respective shares on their rst day of trading after their admission to the Ofcial List of the London Stock Exchange on 11

October 2006).

For GUS plc shares acquired prior to the demerger of Burberry on 13 December 2005 which are affected by both the Burberry

demerger and the subsequent separation of Experian and Home Retail Group, the original CGT base cost is apportioned 50.604%

to Experian plc shares, 36.293% to Home Retail Group plc shares and 13.103% to Burberry Group plc shares.

Shareholder security

Shareholders are advised to be wary of any unsolicited advice, offers to buy shares at a discount or offers of free reports about

the Company. More detailed information on such matters can be found at www.moneymadeclear.fsa.gov.uk. Details of any share

dealing facilities that the Company endorses will be included on the Company’s website or in Company mailings.

The Unclaimed Assets Register

Experian owns and participates in The Unclaimed Assets Register, which provides a search facility for shareholdings and other

nancial assets that may have been forgotten. For further information, please contact The Unclaimed Assets Register, PO Box

9501, Nottingham, NG80 1WD, United Kingdom (T +44 (0) 870 241 1713), or visit www.uar.co.uk.