Experian 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

Introduction

2 – 11

Business review

12 – 51

Financial statements

85 – 160

Governance

52 – 84

The Remuneration Committee has reviewed the overall quantum of the remuneration package for executive directors relative

to relevant market benchmarks and has concluded that no grants will be made to executive directors under the Experian share

option plan in 2010. This plan remains part of the suite of long-term incentives which the Committee may choose to use in

subsequent years, if circumstances warrant this. The Committee has also considered again the performance measures used

across all incentive plans and decided to include cumulative operating cash ow as an additional performance measure for the

co-investment plan (‘CIP’). Performance targets for awards to be made in 2010 have been increased from those for the awards

made in 2009 to reect the improving economic climate. The revised arrangements will reduce the proportion of incentives which

are determined with reference to prot based performance measures.

Further details of how remuneration arrangements were operated during 2009/10 and are intended to be operated going forward

are set out in the following pages.

Service contracts

Each executive director has a rolling service contract which can be terminated by the Group giving twelve months’ notice. In

the event of termination of the director’s contract, any compensation payment is calculated in accordance with normal legal

principles, including the application of mitigation to the extent appropriate in the circumstances of the case. Further details are

provided in the section titled 'Executive directors’ service contracts'.

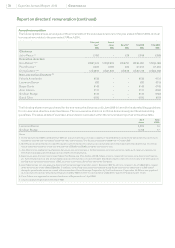

Remuneration of executive directors

Each element of reward is important and has a specic role in achieving the aims of the remuneration philosophy. The combined

potential remuneration from annual bonus and share-based incentives outweighs the other elements and is subject to

performance conditions, thereby placing much of it at risk. In fair value terms, the proportion of the executive directors’ total

remuneration (excluding pension and benets) which is variable is approximately 74%, as illustrated.

Fixed remuneration

Base salary and benets

To assess the appropriate market salary for a role, external remuneration consultants provide benchmark data to the

Remuneration Committee. Executive directors’ salaries are benchmarked against the mid-market of executive directors from

the companies in the FTSE 100 Index and other global comparators, reecting the markets from which Experian recruits talent.

These include, but are not limited to, international companies of a similar size and geographic scope, companies in the nancial

services and related industries and companies with signicant operations in the same markets as Experian (for example, North

America). Before making a nal decision on individual salary awards, the Committee assesses each director’s contribution to

the business to reect individual performance and experience as well as the average pay increase awarded for other employees

in the Group.

The Chief Executive Ofcer (‘CEO’) has not received an increase in base salary since 1 April 2007 and the other executive

directors last received a base salary increase on 1 April 2008. The Committee reviewed salaries in early 2010 and. taking into

account the factors described above, approved increases as detailed below:

In addition to base salary, executive directors receive certain benets-in-kind including a car or car allowance, private health

cover and life assurance. These are set at market norms for each role.

Salary to

31 March 2010

Salary from

1 April 2010

Don Robert US$1,400,000 US$1,450,000

Paul Brooks £460,000 £475,000

Chris Callero US$900,000 US$930,000

Fair value of executive director remuneration

Variable: short-term

Fixed

Variable: long-term

82