Experian 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Business review26

UK and Ireland

There was a resilient performance within continuing activities in the UK and

Ireland. Interactive delivered strong growth, which enabled the region to largely

withstand challenges in the nancial services and retail sectors. There was

signicant margin progress, up 220 basis points, reecting strong execution on

cost efciencies.

Decision Analytics

Total revenue at constant exchange

rates and organic revenue declined by

8%. Market conditions during the year

were challenging, reecting capital

expenditure constraints within the

nancial services sector, which reduced

appetite for large software installations.

Performance was also impacted

by lower transaction volumes. This

was partially mitigated by growth in

analytics and fraud prevention tools.

Credit Services

Total revenue at constant exchange

rates and organic revenue at Credit

Services declined by 6%. The economic

environment during the year was

challenging as the tight supply of credit,

coupled with weak consumer demand,

gave rise to reductions in origination

volumes. Revenue weakness also

reected ongoing headwinds relating

to nancial services consolidation

and market exits. There was

continued progress in vertical market

diversication, with growth in public

sector, utilities and telecoms revenues.

Vertical market •

expansion helps offset

challenging market

conditions

Good growth in demand •

for fraud prevention tools

Digital media activities •

performed well

Interactive delivers •

strong revenue growth;

up 38% organic

Cost efciencies drive •

margin growth

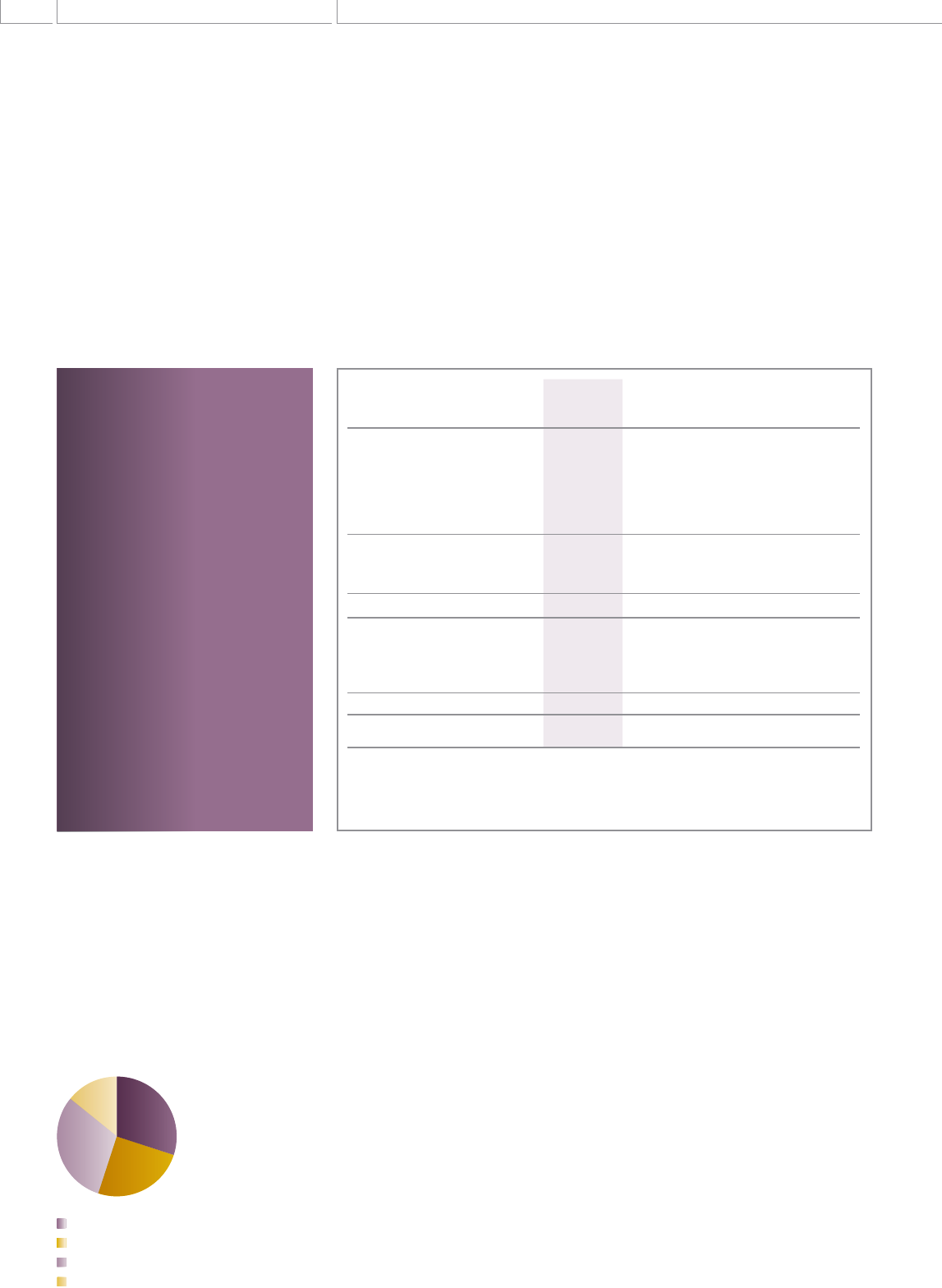

2010 Revenue by activity1

Decision Analytics

Credit Services

Marketing Services

Interactive

1 Excludes discontinuing activities

Year ended 31 March

2010

US$m

2009

US$m

Total

growth1

%

Organic

growth1

%

Revenue

Credit Services 234 265 (6) (6)

Decision Analytics 193 226 (8) (8)

Marketing Services 243 268 (4) (2)

Interactive 109 84 38 38

Total – continuing

activities 779 843 (1) (1)

Discontinuing activities213 59 n/a

Total UK and Ireland 792 902 (6)

EBIT

Continuing activities 212 211 7

Discontinuing activities2-2n/a

Total UK and Ireland 212 213 6

EBIT margin327.2% 25.0%

1. Growth at constant exchange rates

2. Discontinuing activities include UK account processing and other smaller activities. The closure of

UK account processing completed in the year ended 31 March 2010

3. EBIT margin is for continuing activities only