Experian 2010 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Financial statements116

Notes to the Group nancial statements (continued)

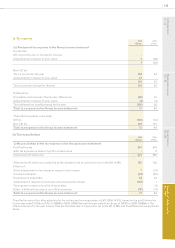

12. Tax expense (continued)

2010

US$m

2009

US$m

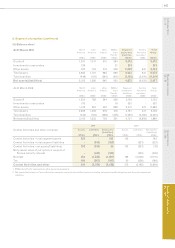

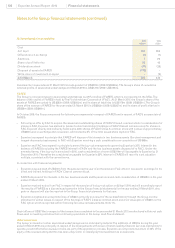

(ii) Reconciliation of the tax expense in the Group income statement to the

Benchmark tax charge

Group tax expense 17 84

Add: one-off tax credit 105 20

Add: tax relief on exceptional items 33 25

Add: tax relief on other non-GAAP measures 29 53

Tax expense on share of prots of associates - 2

Tax on Benchmark PBT 184 184

The effective rate of tax based on Benchmark PBT of US$910m (2009: US$843m) and the associated tax charge of US$184m

(2009: US$184m), excluding the effect of a one-off tax credit of US$105m (2009: US$20m), is 20.2% (2009: 21.8%). The one-off

deferred tax credit in the year ended 31 March 2010 involves UK entities that are still part of the Group but is excluded from the

calculation of the effective rate of tax based on Benchmark PBT in view of the size and the non-recurring nature of this benet.

The one-off corporation tax credit in the year ended 31 March 2009 was excluded from the calculation of the effective rate of tax

based on Benchmark PBT as it related to arrangements involving entities no longer part of the Group. A further tax credit of

US$24m arose in the year ended 31 March 2010 following resolution of historic positions and the tax expense of US$17m in the

Group income statement and the tax on Benchmark PBT of US$184m are both stated after this credit.

(c) Factors that may affect future tax charges

In the foreseeable future, the Group’s tax charge will continue to be inuenced by the prole of prots earned in the different

countries in which the Group’s businesses operate and could be affected by changes in tax law.

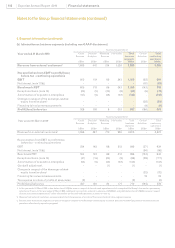

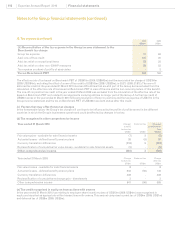

(d) Tax recognised in other comprehensive income

Year ended 31 March 2010 Charge/

(credit)

before tax

US$m

Deferred tax

US$m

Charge/

(credit) after

tax

US$m

Fair value gains - available for sale nancial assets (7) 2(5)

Actuarial losses - dened benet pension plans 28 (8) 20

Currency translation differences (218) 9(209)

Reclassication of cumulative fair value losses - available for sale nancial assets (5) - (5)

Other comprehensive income (202) 3(199)

Year ended 31 March 2009 Charge

before tax

US$m

Deferred tax

US$m

Charge

after tax

US$m

Fair value losses - available for sale nancial assets 8 - 8

Actuarial losses - dened benet pension plans 202 (56) 146

Currency translation differences 428 - 428

Reclassication of cumulative exchange gain - divestments 3 - 3

Other comprehensive income 641 (56) 585

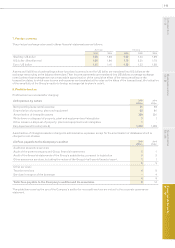

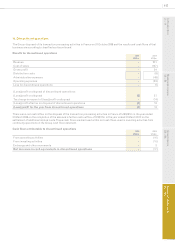

(e) Tax credit recognised in equity on transactions with owners

In the year ended 31 March 2010, tax relating to employee share incentive plans of US$12m (2009: US$4m) was recognised in

equity and reported as appropriate within transactions with owners. This amount comprised current tax of US$4m (2009: US$1m)

and deferred tax of US$8m (2009: US$3m).