Experian 2010 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Experian Annual Report 2010 Financial statements156

Notes to the parent company nancial statements (continued)

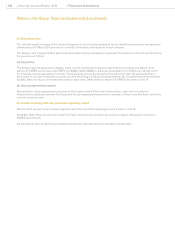

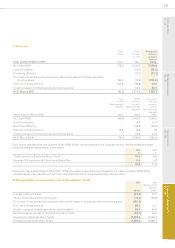

I. Debtors - amounts due within one year

2010

US$m

2009

(Represented)

(Note B)

US$m

Amounts owed by subsidiary undertakings 2,856.6 2,998.7

Other prepayments and accrued income -0.4

Other debtors 2.2 -

2,858.8 2,999.1

Amounts owed by subsidiary undertakings are primarily unsecured, interest free and have no xed date for repayment.

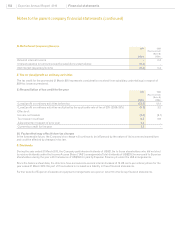

J. Creditors - amounts due within one year

2010

US$m

2009

(Represented)

(Note B)

US$m

Bank overdraft 0.1 -

Amounts owed to subsidiary undertakings 92.4 91.0

Accruals and deferred income 1.2 1.3

Other creditors 0.3 0.3

94.0 92.6

Amounts owed to subsidiary undertakings are unsecured, interest free and have no xed date for repayment.

At 31 March 2010, the Company had undrawn committed borrowing facilities of US$1,932m (2009: US$1,257m), which expire in

June 2012.

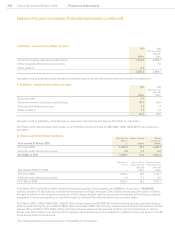

K. Share capital and share premium

Year ended 31 March 2010

Number of

shares

m

Share capital

US$m

Share

premium

US$m

At 1 April 2009 1,025.3 78.5 1,120.1

Allotted under share option plans 0.8 0.1 4.2

At 31 March 2010 1,026.1 78.6 1,124.3

Year ended 31 March 2009

Number of

shares

m

Share capital

(Represented)

(Note B)

US$m

Share premium

(Represented)

(Note B)

US$m

At 1 April 2008 1,023.4 78.4 1,114.1

Allotted under share option plans 1.9 0.1 6.0

At 31 March 2009 1,025.3 78.5 1,120.1

At 31 March 2010 and 31 March 2009, the authorised share capital of the Company was US$200m, divided into 1,999,999,980

ordinary shares of 10 US cents each and 20 deferred shares of 10 US cents each. The ordinary shares carry the right to dividend,

the right to attend or vote at general meetings of the Company and the right to participate in the assets of the Company beyond

repayment of the amounts paid up or credited as paid up on them. The deferred shares carry no such rights.

At 31 March 2010, 1,026,074,681 (2009: 1,025,351,744) ordinary shares and 20 (2009: 20) deferred shares had been allotted, called up

and fully paid. During the year ended 31 March 2010, some 0.8m (2009: 1.9m) ordinary shares were allotted on the exercise of share

options. Since 31 March 2010, 8,060 ordinary shares have been issued on the exercise of share options. Allotments of ordinary

shares have been made in connection with the Group’s share-based payment arrangements, details of which are given in note 29

to the Group nancial statements.

The Company’s share premium account is not available for distribution.