Experian 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

Experian Annual Report 2010 Financial statements124

Notes to the Group nancial statements (continued)

21. Trade and other receivables (continued)

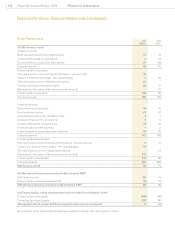

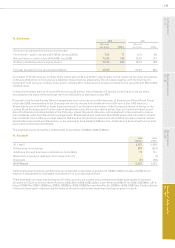

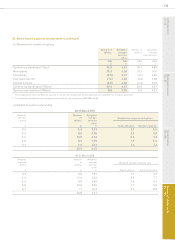

(d) Trade receivables of US$182m (2009: US$134m) were past due but not considered impaired and these are further analysed as

follows:

Current

2010

US$m

Current

2009

US$m

Up to three months 159 108

Three to six months 15 20

Over six months 8 6

182 134

(e) Trade receivables of US$54m (2009: US$29m) were considered partially impaired and provided for and these are further

analysed as follows:

Current

2010

US$m

Current

2009

US$m

Up to three months 12 9

Three to six months 15 9

Over six months 27 11

54 29

Impairment provision (38) (25)

16 4

The other classes within trade and other receivables at the balance sheet dates do not include any impaired assets.

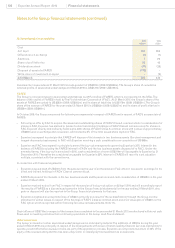

(f) Movements in the impairment provision are as follows:

2010

US$m

2009

US$m

At 1 April 25 24

Differences on exchange 2 (3)

Provision for receivables impairment 29 13

Provision utilised in respect of debts written off (12) (6)

Unused amounts reversed (6) (3)

At 31 March 38 25

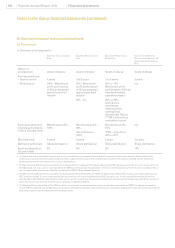

The impairment provision has been determined by reference to the age of the receivable and an assessment of the portion of the

receivable expected to be recovered. Amounts charged and credited to the Group income statement in respect of this provision

are included in administrative expenses. Other provisions in respect of trade receivables mainly comprise credit note provisions.