Wells Fargo 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

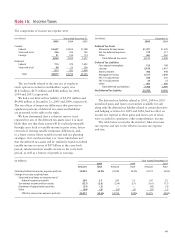

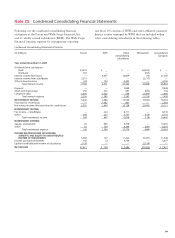

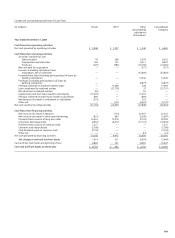

(in millions) December 31, Year ended December 31,

Total loans(1) Delinquent loans(2) Net charge-offs (recoveries)

2005 2004 2005 2004 2005 2004

Commercial and commercial real estate:

Commercial $ 61,552 $ 54,517 $ 304 $ 371 $ 273 $ 274

Other real estate mortgage 45,042 48,402 344 370 11 32

Real estate construction 13,406 9,025 40 63 (7) (1)

Lease financing 5,400 5,169 45 68 14 36

Total commercial and commercial real estate 125,400 117,113 733 872 291 341

Consumer:

Real estate 1-4 family first mortgage 136,261 132,703 709 724 90 47

Real estate 1-4 family junior lien mortgage 59,143 52,190 194 132 105 83

Credit card 12,009 10,260 159 150 467 401

Other revolving credit and installment 48,287 43,744 470 476 1,115 699

Total consumer 255,700 238,897 1,532 1,482 1,777 1,230

Foreign 5,930 4,527 71 99 239 122

Total loans owned and securitized 387,030 360,537 $2,336 $2,453 $2,307 $1,693

Less:

Securitized loans 35,047 34,489

Mortgages held for sale 40,534 29,723

Loans held for sale 612 8,739

Total loans held $310,837 $287,586

(1) Represents loans on the balance sheet or that have been securitized, but excludes securitized loans that we continue to service but as to which we have no other

continuing involvement.

(2) Includes nonaccrual loans and loans 90 days or more past due and still accruing.

This table presents information about the principal balances of owned and securitized loans.

We are a variable interest holder in certain special-purpose

entities that are consolidated because we absorb a majority

of each entity’s expected losses, receive a majority of each

entity’s expected returns or both. We do not hold a majority

voting interest in these entities. Our consolidated variable

interest entities (VIEs), substantially all of which were

formed to invest in securities and to securitize real estate

investment trust securities, had approximately $2.5 billion

and $6 billion in total assets at December 31, 2005 and

2004, respectively. The primary activities of these entities

consist of acquiring and disposing of, and investing and

reinvesting in securities, and issuing beneficial interests secured

by those securities to investors. The creditors of most of these

consolidated entities have no recourse against us.

We also hold variable interests greater than 20% but

less than 50% in certain special-purpose entities formed

to provide affordable housing and to securitize corporate

debt that had approximately $3 billion in total assets at

December 31, 2005 and 2004. We are not required to

consolidate these entities. Our maximum exposure to loss

as a result of our involvement with these unconsolidated

variable interest entities was approximately $870 million

and $950 million at December 31, 2005 and 2004, respectively,

predominantly representing investments in entities formed to

invest in affordable housing. We, however, expect to recover

our investment over time primarily through realization of

federal low-income housing tax credits.

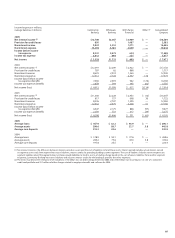

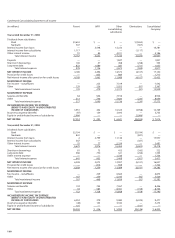

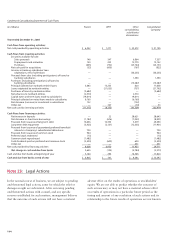

($ in millions) Retained

interest – AAA

mortgage-

backed

securities

Fair value of retained interests $3,358

Expected weighted-average life (in years) 2.2

Prepayment speed assumption (annual CPR) 28.1%

Decrease in fair value from 10% adverse change $ —

Decrease in fair value from 25% adverse change —

Discount spread to LIBOR curve assumption .22%

Decrease in fair value from 10 basis point adverse change $ 7

Decrease in fair value from 20 basis point adverse change 14

The sensitivities in the previous tables are hypothetical

and should be relied on with caution. Changes in fair value

based on a 10% variation in assumptions generally cannot

be extrapolated because the relationship of the change in

the assumption to the change in fair value may not be linear.

Also, in the previous tables, the effect of a variation in a

particular assumption on the fair value of the retained

interest is calculated independently without changing any

other assumption. In reality, changes in one factor may result

in changes in another (for example, changes in prepayment

speed estimates could result in changes in the discount rates),

which might magnify or counteract the sensitivities.