Wells Fargo 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Earnings Performance

Net Interest Income

Net interest income is the interest earned on debt securities,

loans (including yield-related loan fees) and other interest-

earning assets minus the interest paid for deposits and long-

term and short-term debt. The net interest margin is the

average yield on earning assets minus the average interest

rate paid for deposits and our other sources of funding. Net

interest income and the net interest margin are presented on

a taxable-equivalent basis to consistently reflect income from

taxable and tax-exempt loans and securities based on a 35%

marginal tax rate.

Net interest income on a taxable-equivalent basis was

$18.6 billion in 2005, compared with $17.3 billion in 2004,

an increase of 8%, reflecting solid loan growth (other than

ARMs) and a relatively flat net interest margin.

Our net interest margin was 4.86% for 2005 and 4.89%

for 2004. During a year in which the Federal Reserve raised

rates eight times and the yield curve flattened, our net interest

margin remained essentially flat compared with a year ago.

Given the prospect of higher short-term interest rates and

a flatter yield curve, beginning in second quarter 2004, as

part of our asset/liability management strategy, we sold the

lowest-yielding ARMs on our balance sheet, replacing some

of these loans with higher-yielding ARMs. Over the last

seven quarters, we sold $65 billion in ARMs at an average

yield of 4.28%. As a result, the average yield on our 1-4

family first mortgage portfolio—which includes ARMs —

increased from 5.19% on an average balance of $89.4 billion

in second quarter 2004 to 6.75% on an average balance

of $76.2 billion in fourth quarter 2005. At year-end 2005,

yields on new ARMs being held for investment within real

estate 1-4 family mortgage loans were more than 1% higher

than the average yield on the ARMs sold since second quarter

2004. Our net interest margin has performed better than our

peers’ due to our balance sheet repositioning actions and our

ability to grow transaction and savings deposits while main-

taining our deposit pricing discipline.

Average earning assets increased $29.2 billion to

$383.5 billion in 2005 from $354.3 billion in 2004. Loans

averaged $296.1 billion in 2005, compared with $269.6 billion

in 2004. Average mortgages held for sale were $39.0 billion

in 2005 and $32.3 billion in 2004. Debt securities available

for sale averaged $33.1 billion in both 2005 and 2004.

Average core deposits are an important contributor to

growth in net interest income and the net interest margin.

This low-cost source of funding rose 9% from 2004. Average

core deposits were $242.8 billion and $223.4 billion and

funded 54.5% and 54.4% of average total assets in 2005

and 2004, respectively. Total average retail core deposits,

which exclude Wholesale Banking core deposits and retail

mortgage escrow deposits, for 2005 grew $18.2 billion,

or 10%, from a year ago. Average mortgage escrow

deposits were $16.7 billion in 2005 and $14.1 billion in

2004. Savings certificates of deposits increased on average

from $18.9 billion in 2004 to $22.6 billion in 2005 and

noninterest-bearing checking accounts and other core

deposit categories increased on average from $204.5 billion

in 2004 to $220.1 billion in 2005. Total average interest-

bearing deposits increased to $194.6 billion in 2005 from

$182.6 billion a year ago. Total average noninterest-bearing

deposits increased to $87.2 billion in 2005 from $79.3 billion

a year ago.

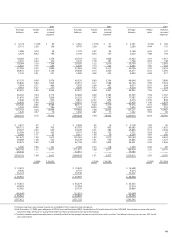

Table 3 presents the individual components of net interest

income and the net interest margin.