Wells Fargo 2005 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

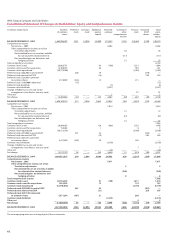

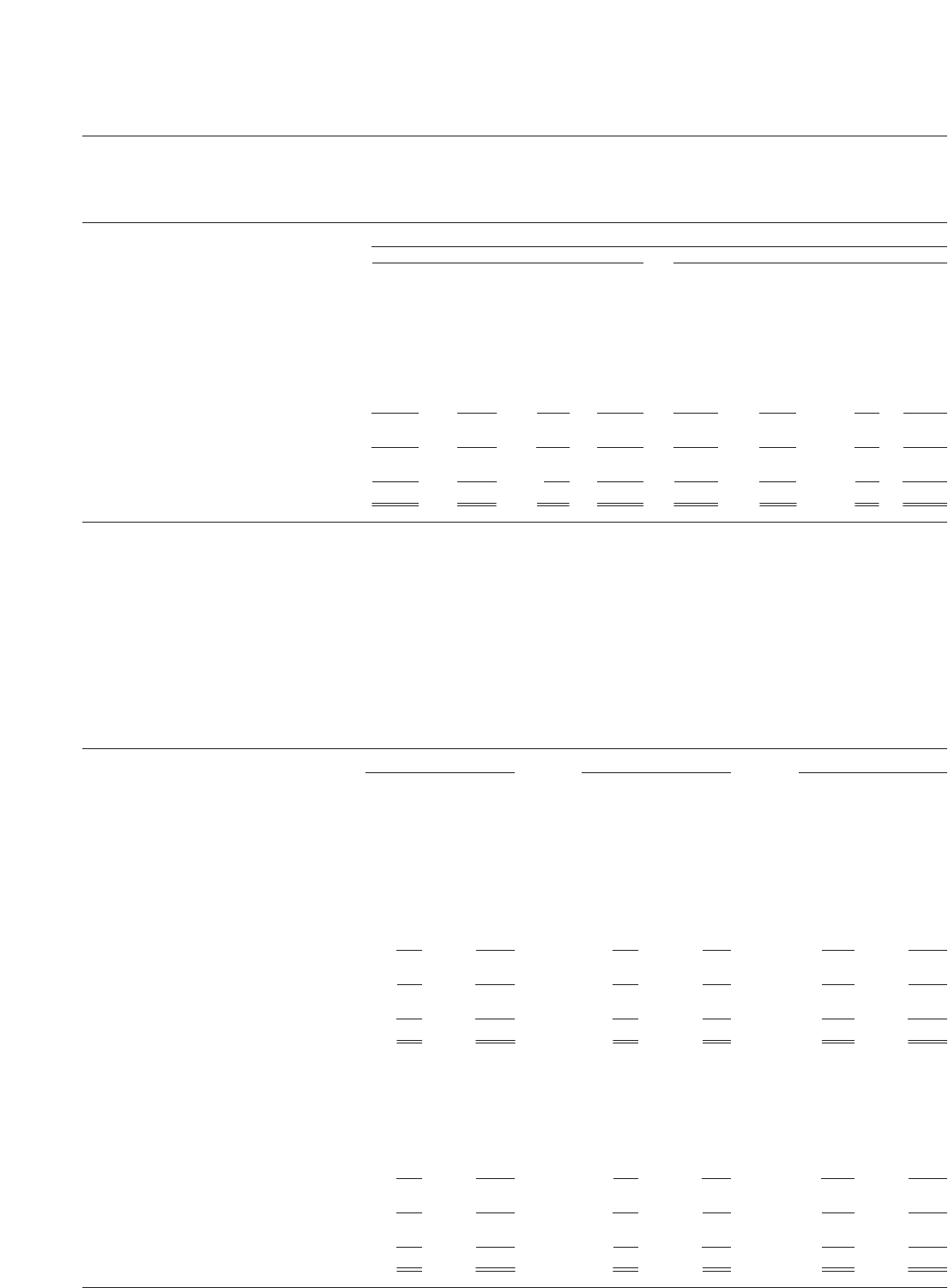

The following table shows the unrealized gross losses

and fair value of securities in the securities available for

sale portfolio at December 31, 2005 and 2004, by length

of time that individual securities in each category had been

in a continuous loss position.

The decline in fair value for the debt securities that had

been in a continuous loss position for 12 months or more at

December 31, 2005, was primarily due to changes in market

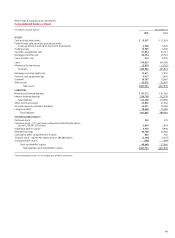

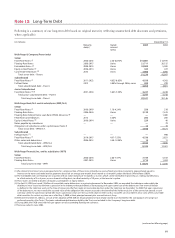

The following table provides the cost and fair value for the

major categories of securities available for sale carried at fair

Note 5: Securities Available for Sale

value. There were no securities classified as held to maturity

as of the periods presented.

interest rates and not due to the credit quality of the securities.

We believe that the principal and interest on these securities

are fully collectible and we have the intent and ability to

retain our investment for a period of time to allow for any

anticipated recovery in market value. We have reviewed these

securities in accordance with our policy and do not consider

them to be other-than-temporarily impaired.

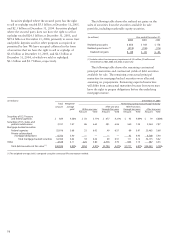

(in millions) December 31,

2005 2004

Cost Unrealized Unrealized Fair Cost Unrealized Unrealized Fair

gross gross value gross gross value

gains losses gains losses

Securities of U.S. Treasury and federal agencies $ 845 $ 4 $ (10) $ 839 $ 1,128 $ 16 $ (4) $ 1,140

Securities of U.S. states and political subdivisions 3,048 149 (6) 3,191 3,429 196 (4) 3,621

Mortgage-backed securities:

Federal agencies 25,304 336 (24) 25,616 20,198 750 (4) 20,944

Private collateralized

mortgage obligations (1) 6,628 128 (6) 6,750 4,082 121 (4) 4,199

Total mortgage-backed securities 31,932 464 (30) 32,366 24,280 871 (8) 25,143

Other 4,518 75 (55) 4,538 2,974 157 (14) 3,117

Total debt securities 40,343 692 (101) 40,934 31,811 1,240 (30) 33,021

Marketable equity securities 558 349 (7) 900 507 198 (9) 696

Total (2) $40,901 $1,041 $(108) $41,834 $32,318 $1,438 $(39) $33,717

(1) Substantially all of the private collateralized mortgage obligations are AAA-rated bonds collateralized by 1-4 family residential first mortgages.

(2) At December 31, 2005, we held no securities of any single issuer (excluding the U.S.Treasury and federal agencies) with a book value that exceeded 10% of stockholders’equity.

(in millions) Less than 12 months 12 months or more Total

Unrealized Fair Unrealized Fair Unrealized Fair

gross value gross value gross value

losses losses losses

December 31, 2005

Securities of U.S. Treasury and federal agencies $ (6) $ 341 $ (4) $142 $ (10) $ 483

Securities of U.S. states and political subdivisions (3) 204 (3) 57 (6) 261

Mortgage-backed securities:

Federal agencies (22) 2,213 (2) 89 (24) 2,302

Private collateralized

mortgage obligations (6) 1,494 — — (6) 1,494

Total mortgage-backed securities (28) 3,707 (2) 89 (30) 3,796

Other (38) 890 (17) 338 (55) 1,228

Total debt securities (75) 5,142 (26) 626 (101) 5,768

Marketable equity securities (7) 185 — — (7) 185

Total $(82) $5,327 $(26) $626 $(108) $5,953

December 31, 2004

Securities of U.S. Treasury and federal agencies $ (4) $ 304 $ — $ — $ (4) $ 304

Securities of U.S. states and political subdivisions (1) 65 (3) 62 (4) 127

Mortgage-backed securities:

Federal agencies (4) 450 — — (4) 450

Private collateralized

mortgage obligations (4) 981 — — (4) 981

Total mortgage-backed securities (8) 1,431 — — (8) 1,431

Other (11) 584 (3) 56 (14) 640

Total debt securities (24) 2,384 (6) 118 (30) 2,502

Marketable equity securities (9) 44 — — (9) 44

Total $(33) $ 2,428 $ (6) $118 $ (39) $ 2,546