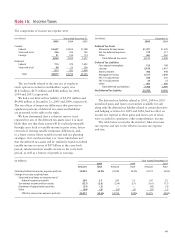

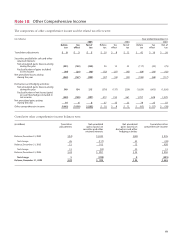

Wells Fargo 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

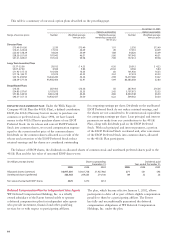

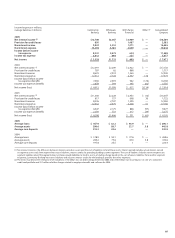

The table to the right provides information for pension

plans with benefit obligations in excess of plan assets,

substantially due to our nonqualified pension plans.

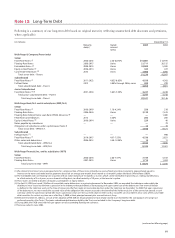

(in millions) December 31,

2005 2004

Projected benefit obligation $359 $294

Accumulated benefit obligation 297 247

Fair value of plan assets 60 55

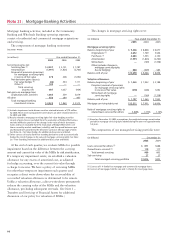

Percentage of plan assets at December 31,

2005 2004

Pension Other Pension Other

plan benefit plan benefit

assets plan assets assets plan assets

Equity securities 69% 58% 63% 51%

Debt securities 27 40 33 46

Real estate 31 31

Other 1 1 1 2

Total 100% 100% 100% 100%

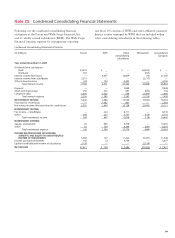

This table reconciles the funded status of the plans to the amounts included in the Consolidated Balance Sheet.

(in millions) December 31,

2005 2004

Pension benefits Pension benefits

Non- Other Non- Other

Qualified qualified benefits Qualified qualified benefits

Funded status (1) $ 899 $(277) $(339) $ 680 $(228) $(422)

Employer contributions in December —24 —1 5

Unrecognized net actuarial loss 615 42 131 647 25 158

Unrecognized net transition asset —— 3 ——3

Unrecognized prior service cost (25)(11)(51) (67)(20) (8)

Accrued benefit income (cost) $1,489 $(244) $(252) $1,260 $(222) $(264)

Amounts recognized in the balance sheet

consist of:

Prepaid benefit cost $1,489 $ — $ — $1,260 $— $—

Accrued benefit liability — (245) (252) — (223) (264)

Accumulated other

comprehensive income — 1 — — 1 —

Accrued benefit income (cost) $ 1,489 $(244) $(252) $1,260 $(222) $(264)

(1) Fair value of plan assets at year end less projected benefit obligation at year end.

The weighted-average allocation of plan assets was:

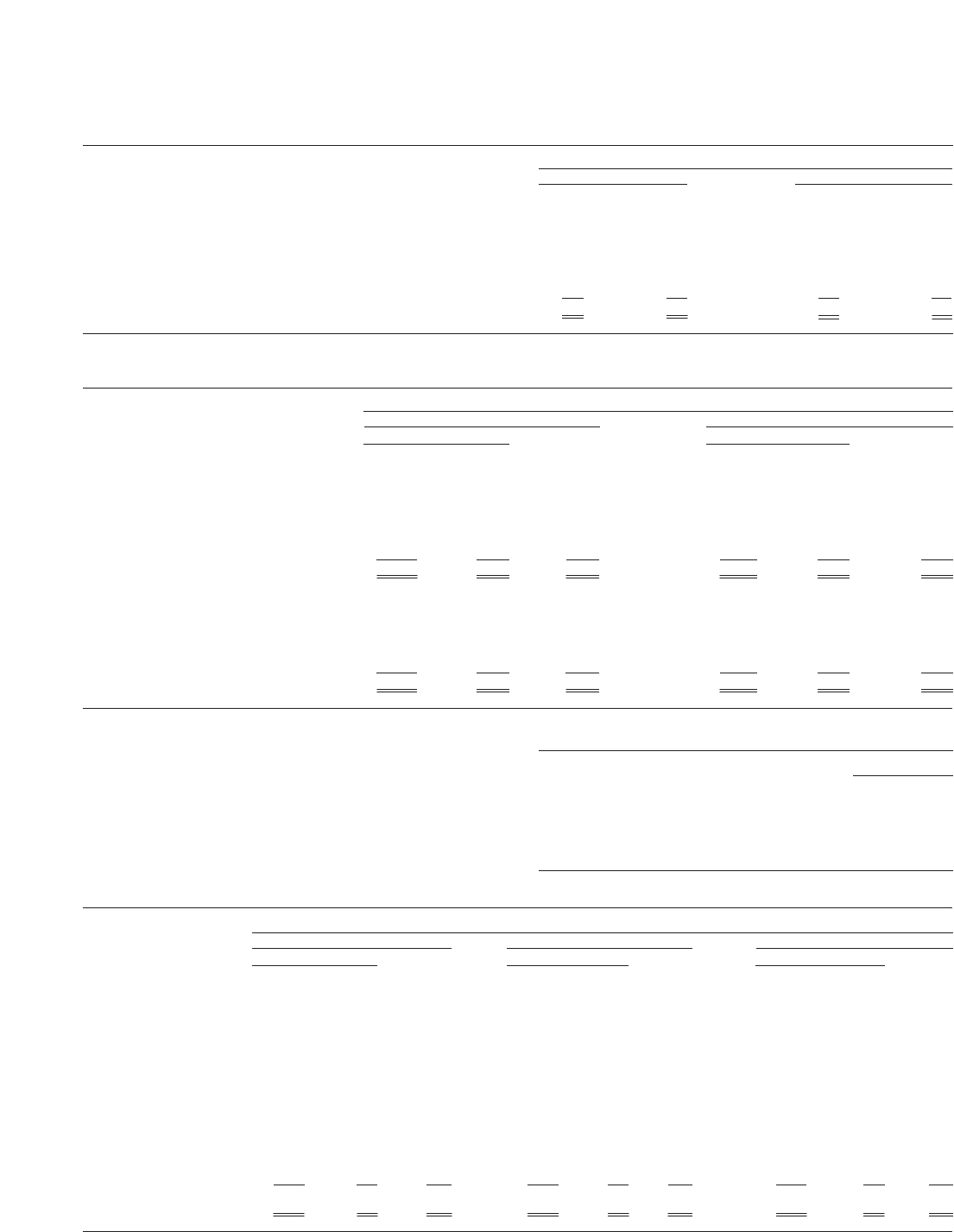

The net periodic benefit cost was:

(in millions) Year ended December 31,

2005 2004 2003

Pension benefits Pension benefits Pension benefits

Non- Other Non- Other Non- Other

Qualified qualified benefits Qualified qualified benefits Qualified qualified benefits

Service cost $ 208 $21 $ 21 $ 170 $23 $ 17 $ 164 $22 $ 15

Interest cost 220 14 41 215 13 43 209 14 42

Expected return

on plan assets (393) — (25) (327) — (23) (275) — (18)

Recognized

net actuarial

loss (gain) (1) 68 3 6 51 1 2 85 7 (3)

Amortization of

prior service cost (4) (2) (1) (1) (1) (1) 16 — (1)

Amortization of

unrecognized

transition asset ——— ——— — — 1

Settlement — — — (2) 2 — — — —

Net periodic

benefit cost $ 99 $36 $ 42 $ 106 $38 $ 38 $ 199 $43 $ 36

(1) Net actuarial loss (gain) is generally amortized over five years.