Wells Fargo 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

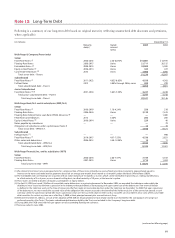

The changes in the carrying amount of goodwill as allocated to our operating segments for goodwill impairment analysis were:

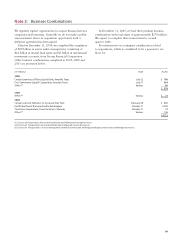

Note 9: Goodwill

For goodwill impairment testing, enterprise-level goodwill

acquired in business combinations is allocated to reporting units

based on the relative fair value of assets acquired and recorded

in the respective reporting units. Through this allocation, we

assigned enterprise-level goodwill to the reporting units that

are expected to benefit from the synergies of the combination.

We used discounted estimated future net cash flows to evaluate

goodwill reported at all reporting units.

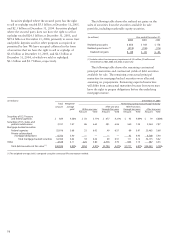

For our goodwill impairment analysis, we allocate all

of the goodwill to the individual operating segments. For

management reporting we do not allocate all of the goodwill

to the individual operating segments: some is allocated at

the enterprise level. See Note 19 for further information

on management reporting. The balances of goodwill for

management reporting were:

(in millions) Community Wholesale Wells Fargo Enterprise Consolidated

Banking Banking Financial Company

December 31, 2004 $ 3,433 $ 1,087 $364 $ 5,797 $ 10,681

December 31, 2005 $3,527 $1,097 $366 $5,797 $10,787

(in millions) Community Wholesale Wells Fargo Consolidated

Banking Banking Financial Company

December 31, 2003 $ 7,286 $ 2,735 $350 $ 10,371

Goodwill from business combinations 5 302 — 307

Foreign currency translation adjustments — — 3 3

December 31, 2004 7,291 3,037 353 10,681

Reduction in goodwill related to divested businesses (31) (3) — (34)

Goodwill from business combinations 125 13 — 138

Realignment of automobile financing business (11) —11—

Foreign currency translation adjustments — — 2 2

December 31, 2005 $7,374 $3,047 $366 $10,787