Wells Fargo 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

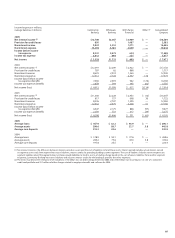

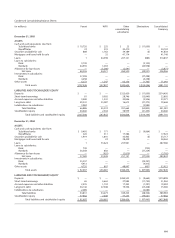

(in millions) December 31,

2005 2004

Deferred Tax Assets

Allowance for loan losses $1,471 $1,430

Net tax-deferred expenses 179 217

Other 461 402

Total deferred tax assets 2,111 2,049

Deferred Tax Liabilities

Core deposit intangibles 153 188

Leasing 2,430 2,461

Mark to market 708 448

Mortgage servicing 3,517 2,848

FAS 115 adjustment 368 535

FAS 133 adjustment 29 23

Other 501 486

Total deferred tax liabilities 7,706 6,989

Net Deferred Tax Liability $5,595 $4,940

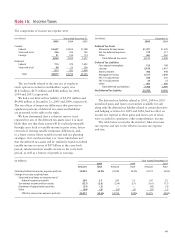

The components of income tax expense were:

The tax benefit related to the exercise of employee

stock options recorded in stockholders’ equity was

$143 million, $175 million and $148 million for 2005,

2004 and 2003, respectively.

We had a net deferred tax liability of $5,595 million and

$4,940 million at December 31, 2005 and 2004, respectively.

The tax effects of temporary differences that gave rise to

significant portions of deferred tax assets and liabilities

are presented in the table to the right.

We have determined that a valuation reserve is not

required for any of the deferred tax assets since it is more

likely than not that these assets will be realized principally

through carry back to taxable income in prior years, future

reversals of existing taxable temporary differences, and,

to a lesser extent, future taxable income and tax planning

strategies. Our conclusion that it is “more likely than not”

that the deferred tax assets will be realized is based on federal

taxable income in excess of $17 billion in the carry-back

period, substantial state taxable income in the carry-back

period, as well as a history of growth in earnings.

Note 16: Income Taxes

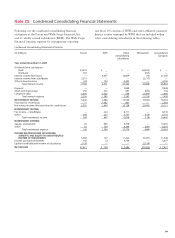

(in millions) Year ended December 31,

2005 2004 2003

Current:

Federal $2,627 $2,815 $1,298

State and local 346 354 165

Foreign 91 154 114

3,064 3,323 1,577

Deferred:

Federal 715 379 1,492

State and local 98 53 206

813 432 1,698

Total $3,877 $3,755 $3,275

The deferred tax liability related to 2005, 2004 or 2003

unrealized gains and losses on securities available for sale

along with the deferred tax liability related to certain derivative

and hedging activities for 2005 and 2004, had no effect on

income tax expense as these gains and losses, net of taxes,

were recorded in cumulative other comprehensive income.

The table below reconciles the statutory federal income

tax expense and rate to the effective income tax expense

and rate.

(in millions) Year ended December 31,

2005 2004 2003

Amount Rate Amount Rate Amount Rate

Statutory federal income tax expense and rate $4,042 35.0% $3,769 35.0% $3,317 35.0%

Change in tax rate resulting from:

State and local taxes on income, net of

federal income tax benefit 289 2.5 265 2.5 241 2.5

Tax-exempt income and tax credits (327) (2.8) (224) (2.1) (161) (1.7)

Donations of appreciated securities (33) (.3) — — (90) (.9)

Other (94)(.8)(55)(.5)(32)(.3)

Effective income tax expense and rate $3,877 33.6% $3,755 34.9% $3,275 34.6%