Wells Fargo 2005 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

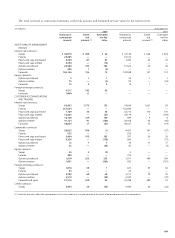

01 02 03 04 05

Revenue (billions)

20-year compound annual growth rate: 12%

$21.0

25.2

28.4

30.1

32.9

02 03 04 05

Active Online Middle-Market/

Large Corporate Customers

(thousands)

18

01

8

22

25

28

02 03 04 05

Active Online

Small Business Customers

(thousands)

297

01

185

415

531

666

01 02 03 04 05

Deposits

(billions)

$187

217

248

275

314

01 02 03 04 05

Mortgage Originations

(billions)

$202

333

470

298

366

01 02 03 04 05

Mortgage Servicing

Portfolio

(billions)

$462

581

710

805

989

National Home Equity

Group Loans

(billions)

01 02 03 04 05

$25

34

49

70

72

Which Measures Really Matter? 2005 Update

01 02 03 04 05

Earnings Per Share diluted**

20-year compound annual growth rate: 14%

$1.97

3.32

3.65

4.09

4.50

01 02 03 04 05

Return on Equity (ROE)

ROE: cents earned for every dollar

stockholders invest in the company

12.7%

18.7

19.4

19.6

19.6

01 02 03 04 05

Retaining Team Members

(annual percent of team members who leave us)

** excludes Wells Fargo Financial

(consumer finance)

34%**

28

25

29

30

01 02 03 04 05

Retaining Customers

(annual percent of high-value* checking

account customers who leave us)

10.4% (est.)

8.9

8.0

* top 20 percent of banking customers

based on balances

7.5

7.5

02 03 04 05

Assets Managed,

Administered

(billions) includes brokerage

$578

654

791

880

02 03 04 05

Nonperforming Assets

(NPAs)/Total Loans

0.88

01

1.08%

0.66

0.55

0.49

02 03 04 05

Products Per Banking

Household

4.2

01

3.8

4.3

4.6

4.8

02 03 04 05

Product Solutions (Sales)

Per Banker* Per Day

4.3

01

4.0

4.7

* platform full-time equivalent (FTE) team member

4.8

4.9

03 04 05

Team Member Engagement

Ratio of engaged to actively disengaged

Gallup survey of Wells Fargo Regional

Banking team members

2.5:1

4.1:1

5.8 :1

1.7 : 1

National average

01 02 03 04 05

Market Capitalization

(billions)

$74

79

100

105

105

The higher a company’s credit rating

(based on its ability to meet debt obli-

gations) the less interest it has to pay

to borrow money.Wells Fargo Bank:

only U.S. bank rated “Aaa.”

Number of S&P companies

Moody’s with higher rating

Wells Fargo Bank,N.A.

Issuer Aaa None

Long-term deposits Aaa None

Financial Strength A None

Wells Fargo & Company

Subordinated Debt Aa2 One

Issuer Aa1 Six

Senior Debt Aa1 Six

Financial Performance*

Retaining Customers,Team Members

Sales

Online

Earning More Business

Managing Risk

In our past two annual reports, we said to you,our owners,that we

measure success differently than our competitors—to reflect more

accurately how financial services companies, like ours, create value

for customers and stockholders.Here’s an update on the progress

we’re making in the areas we believe are the best long-term

indicators for future success in the financial services industry.

02 03 04 05

Commercial/Corporate

Products Per Banking

Customer

4.9

01

4.6

5.0

5.3

5.7

02 03 04 05

Retail Banking Households

with Credit Cards

23.7

01

23.2%

26.9

31.1

33.1

02 03 04 05

Retail Checking Households

with Debit Cards

85.4

01

83.3%

85.9

88.7

90.5

* before effect of change in accounting principles,2001 includes venture capital impairment

** includes all common stock equivalents (”in the money stock”options,warrants and rights,convertible bonds and convertible preferred stock)