Wells Fargo 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

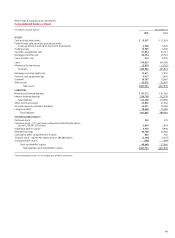

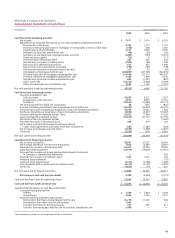

Wells Fargo & Company and Subsidiaries

Consolidated Balance Sheet

(in millions, except shares) December 31,

2005 2004

ASSETS

Cash and due from banks $ 15,397 $ 12,903

Federal funds sold, securities purchased under

resale agreements and other short-term investments 5,306 5,020

Trading assets 10,905 9,000

Securities available for sale 41,834 33,717

Mortgages held for sale 40,534 29,723

Loans held for sale 612 8,739

Loans 310,837 287,586

Allowance for loan losses (3,871) (3,762)

Net loans 306,966 283,824

Mortgage servicing rights, net 12,511 7,901

Premises and equipment, net 4,417 3,850

Goodwill 10,787 10,681

Other assets 32,472 22,491

Total assets $481,741 $427,849

LIABILITIES

Noninterest-bearing deposits $ 87,712 $ 81,082

Interest-bearing deposits 226,738 193,776

Total deposits 314,450 274,858

Short-term borrowings 23,892 21,962

Accrued expenses and other liabilities 23,071 19,583

Long-term debt 79,668 73,580

Total liabilities 441,081 389,983

STOCKHOLDERS’ EQUITY

Preferred stock 325 270

Common stock – $12/3par value, authorized 6,000,000,000 shares;

issued 1,736,381,025 shares 2,894 2,894

Additional paid-in capital 9,934 9,806

Retained earnings 30,580 26,482

Cumulative other comprehensive income 665 950

Treasury stock – 58,797,993 shares and 41,789,388 shares (3,390) (2,247)

Unearned ESOP shares (348) (289)

Total stockholders’ equity 40,660 37,866

Total liabilities and stockholders’ equity $481,741 $427,849

The accompanying notes are an integral part of these statements.