Wells Fargo 2005 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

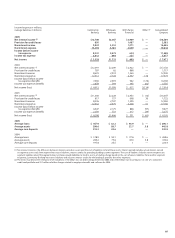

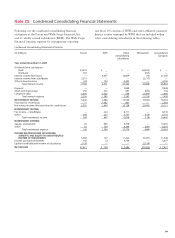

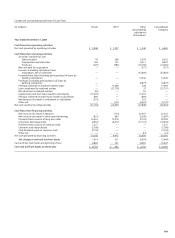

Condensed Consolidating Statements of Income

(in millions) Parent WFFI Other Eliminations Consolidated

consolidating Company

subsidiaries

Year ended December 31, 2004

Dividends from subsidiaries:

Bank $3,652 $ — $ — $(3,652) $ —

Nonbank 307 — — (307) —

Interest income from loans — 3,548 13,233 — 16,781

Interest income from subsidiaries 1,117 — — (1,117) —

Other interest income 91 84 4,011 —4,186

Total interest income 5,167 3,632 17,244 (5,076) 20,967

Deposits — — 1,827 — 1,827

Short-term borrowings 106 47 458 (258) 353

Long-term debt 872 1,089 387 (711) 1,637

Total interest expense 978 1,136 2,672 (969) 3,817

NET INTEREST INCOME 4,189 2,496 14,572 (4,107) 17,150

Provision for credit losses —833 884 —1,717

Net interest income after provision for credit losses 4,189 1,663 13,688 (4,107) 15,433

NONINTEREST INCOME

Fee income –nonaffiliates — 223 7,319 — 7,542

Other 139 256 5,053 (81)5,367

Total noninterest income 139 479 12,372 (81)12,909

NONINTEREST EXPENSE

Salaries and benefits 64 944 7,916 — 8,924

Other 313 746 7,820 (230) 8,649

Total noninterest expense 377 1,690 15,736 (230) 17,573

INCOME BEFORE INCOME TAX EXPENSE

(BENEFIT) AND EQUITY IN UNDISTRIBUTED

INCOME OF SUBSIDIARIES 3,951 452 10,324 (3,958) 10,769

Income tax expense (benefit) (97) 159 3,693 — 3,755

Equity in undistributed income of subsidiaries 2,966 — — (2,966) —

NET INCOME $7,014 $ 293 $ 6,631 $(6,924) $ 7,014

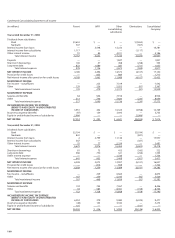

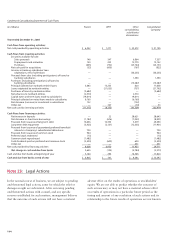

Year ended December 31, 2003

Dividends from subsidiaries:

Bank $5,194 $ — $ — $(5,194) $ —

Nonbank 841 — — (841) —

Interest income from loans 2 2,799 11,136 — 13,937

Interest income from subsidiaries 567 — — (567) —

Other interest income 75 77 5,329 —5,481

Total interest income 6,679 2,876 16,465 (6,602) 19,418

Short-term borrowings 81 73 413 (245) 322

Long-term debt 560 730 321 (256) 1,355

Other interest expense — — 1,734 —1,734

Total interest expense 641 803 2,468 (501) 3,411

NET INTEREST INCOME 6,038 2,073 13,997 (6,101) 16,007

Provision for credit losses — 814 908 —1,722

Net interest income after provision for credit losses 6,038 1,259 13,089 (6,101) 14,285

NONINTEREST INCOME

Fee income –nonaffiliates — 209 6,664 — 6,873

Other 167 239 5,195 (92)5,509

Total noninterest income 167 448 11,859 (92)12,382

NONINTEREST EXPENSE

Salaries and benefits 134 745 7,567 — 8,446

Other 18 583 8,301 (158) 8,744

Total noninterest expense 152 1,328 15,868 (158) 17,190

INCOME BEFORE INCOME TAX EXPENSE

(BENEFIT) AND EQUITY IN UNDISTRIBUTED

INCOME OF SUBSIDIARIES 6,053 379 9,080 (6,035) 9,477

Income tax expense (benefit) (48) 143 3,180 — 3,275

Equity in undistributed income of subsidiaries 101 — — (101) —

NET INCOME $6,202 $ 236 $ 5,900 $(6,136) $ 6,202