Wells Fargo 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

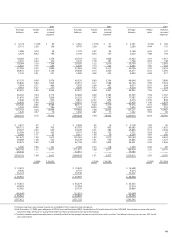

Table 3: Average Balances,Yields and Rates Paid (Taxable-Equivalent Basis) (1)(2)

(in millions) 2005 2004

Average Yields/ Interest Average Yields/ Interest

balance rates income/ balance rates income/

expense expense

EARNING ASSETS

Federal funds sold, securities purchased under

resale agreements and other short-term investments $ 5,448 3.01% $ 164 $ 4,254 1.49% $ 64

Trading assets 5,411 3.52 190 5,286 2.75 145

Debt securities available for sale

(3)

:

Securities of U.S. Treasury and federal agencies 997 3.81 38 1,161 4.05 46

Securities of U.S. states and political subdivisions 3,395 8.27 266 3,501 8.00 267

Mortgage-backed securities:

Federal agencies 19,768 6.02 1,162 21,404 6.03 1,248

Private collateralized mortgage obligations 5,128 5.60 283 3,604 5.16 180

Total mortgage-backed securities 24,896 5.94 1,445 25,008 5.91 1,428

Other debt securities (4) 3,846 7.10 266 3,395 7.72 236

Total debt securities available for sale

(4)

33,134 6.24 2,015 33,065 6.24 1,977

Mortgages held for sale (3) 38,986 5.67 2,213 32,263 5.38 1,737

Loans held for sale (3) 2,857 5.10 146 8,201 3.56 292

Loans:

Commercial and commercial real estate:

Commercial 58,434 6.76 3,951 49,365 5.77 2,848

Other real estate mortgage 29,098 6.31 1,836 28,708 5.35 1,535

Real estate construction 11,086 6.67 740 8,724 5.30 463

Lease financing 5,226 5.91 309 5,068 6.23 316

Total commercial and commercial real estate 103,844 6.58 6,836 91,865 5.62 5,162

Consumer:

Real estate 1-4 family first mortgage 78,170 6.42 5,016 87,700 5.44 4,772

Real estate 1-4 family junior lien mortgage 55,616 6.61 3,679 44,415 5.18 2,300

Credit card 10,663 12.33 1,315 8,878 11.80 1,048

Other revolving credit and installment 43,102 8.80 3,794 33,528 9.01 3,022

Total consumer 187,551 7.36 13,804 174,521 6.38 11,142

Foreign 4,711 13.49 636 3,184 15.30 487

Total loans (5) 296,106 7.19 21,276 269,570 6.23 16,791

Other 1,581 4.34 68 1,709 3.81 65

Total earning assets $383,523 6.81 26,072 $354,348 5.97 21,071

FUNDING SOURCES

Deposits:

Interest-bearing checking $ 3,607 1.43 51 $ 3,059 .44 13

Market rate and other savings 129,291 1.45 1,874 122,129 .69 838

Savings certificates 22,638 2.90 656 18,850 2.26 425

Other time deposits 27,676 3.29 910 29,750 1.43 427

Deposits in foreign offices 11,432 3.12 357 8,843 1.40 124

Total interest-bearing deposits 194,644 1.98 3,848 182,631 1.00 1,827

Short-term borrowings 24,074 3.09 744 26,130 1.35 353

Long-term debt 79,137 3.62 2,866 67,898 2.41 1,637

Guaranteed preferred beneficial interests in Company’s

subordinated debentures (6) — — — — — —

Total interest-bearing liabilities 297,855 2.50 7,458 276,659 1.38 3,817

Portion of noninterest-bearing funding sources 85,668 — — 77,689 — —

Total funding sources $383,523 1.95 7,458 $354,348 1.08 3,817

Net interest margin and net interest income on

a taxable-equivalent basis (7) 4.86% $18,614 4.89% $17,254

NONINTEREST-EARNING ASSETS

Cash and due from banks $ 13,173 $ 13,055

Goodwill 10,705 10,418

Other 38,389 32,758

Total noninterest-earning assets $ 62,267 $ 56,231

NONINTEREST-BEARING FUNDING SOURCES

Deposits $ 87,218 $ 79,321

Other liabilities 21,559 18,764

Stockholders’ equity 39,158 35,835

Noninterest-bearing funding sources used to

fund earning assets (85,668) (77,689)

Net noninterest-bearing funding sources $ 62,267 $ 56,231

TOTAL ASSETS $445,790 $410,579

(1) Our average prime rate was 6.19%, 4.34%, 4.12%, 4.68% and 6.91% for 2005, 2004, 2003, 2002 and 2001, respectively.The average three-month London Interbank

Offered Rate (LIBOR) was 3.56%, 1.62%, 1.22%, 1.80% and 3.78% for the same years, respectively.

(2) Interest rates and amounts include the effects of hedge and risk management activities associated with the respective asset and liability categories.

(3) Yields are based on amortized cost balances computed on a settlement date basis.

(4) Includes certain preferred securities.