Wells Fargo 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Wells Fargo & Company is a $482 billion diversified financial

services company providing banking, insurance, investments,

mortgage banking and consumer finance through banking

stores, the internet and other distribution channels to con-

sumers, businesses and institutions in all 50 states of the

U.S. and in other countries. We ranked fifth in assets and

fourth in market value of our common stock among U.S.

bank holding companies at December 31, 2005. When we

refer to “the Company,” “we,” “our” and “us” in this

Report, we mean Wells Fargo & Company and Subsidiaries

(consolidated). When we refer to “the Parent,” we mean

Wells Fargo & Company.

We had another exceptional year in 2005, with record

diluted earnings per share of $4.50, record net income of

$7.7 billion and solid market share growth across our more

than 80 businesses. Our earnings growth from a year ago was

broad based, with nearly every consumer and commercial

business line achieving double-digit profit growth, including

regional banking, private client services, corporate trust,

business direct, asset-based lending, student lending, consumer

credit, commercial real estate and international trade services.

Both net interest income and noninterest income for 2005

grew solidly from last year and virtually all of our fee-based

products had double-digit revenue growth. We took significant

actions to reposition our balance sheet in 2005 designed to

improve yields on earning assets, including the sale of $48 billion

of our lowest-yielding adjustable rate mortgages (ARMs),

resulting in $119 million of sales-related losses, and the

sale of $17 billion of debt securities, including low-yielding

fixed-income securities, resulting in $120 million of losses.

Our growth in earnings per share was driven by revenue

growth, operating leverage (revenue growth in excess of

expense growth) and credit quality, which remained solid

despite the following credit-related events:

• $171 million of net charge-offs from incremental

consumer bankruptcy filings nationwide due to a

change in bankruptcy law in October 2005;

• $163 million first quarter 2005 initial implementation

of conforming to more stringent Federal Financial

Institutions Examination Council (FFIEC) charge-off

rules at Wells Fargo Financial; and

• $100 million provision for credit losses for our

assessment of the effect of Hurricane Katrina.

Our primary sources of earnings are driven by lending

and deposit taking activities, which generate net interest

income, and providing financial services that generate fee

income.

Revenue grew 10% from 2004. In addition to double-digit

growth in earnings per share, we also had double-digit growth

in average loans. We have been achieving these results not just

for one year, but for the past five, 10, 15 and 20 years. Our

total shareholder return the past five years was 10 times that

of the S&P 500®

, and almost double the S&P 500 including

the past 10, 15 and 20 years. These periods included almost

every economic cycle and economic condition a financial

institution can experience, including high and low interest

rates, high and low unemployment, bubbles and recessions

and all types of yield curves – steep, flat and inverted. For us

to achieve double-digit growth through different economic

cycles, our primary strategy, consistent for 20 years, is to

satisfy all our customers’ financial needs, help them succeed

financially and, through cross-selling, gain market share,

wallet share and earn 100% of their business.

We have stated in the past that to consistently grow

over the long term, successful companies must invest in their

core businesses and in maintaining strong balance sheets.

We continued to make investments in 2005 by opening 92

banking stores, seven commercial banking offices, 47 mortgage

stores and 20 consumer finance stores. We continued to

be #1 nationally in retail mortgage originations, home

equity lending, small business lending, agricultural lending,

consumer internet banking, and providing financial services

to middle-market companies in the western U.S.

Overview

This Annual Report, including the Financial Review and the Financial Statements and related Notes, has forward-looking

statements, which may include forecasts of our financial results and condition, expectations for our operations and business, and

our assumptions for those forecasts and expectations. Do not unduly rely on forward-looking statements. Actual results might

differ significantly from our forecasts and expectations due to several factors. Some of these factors are described in the Financial

Review and in the Financial Statements and related Notes. For a discussion of other factors, refer to the “Risk Factors” and

“Regulation and Supervision” sections of our Annual Report on Form 10-K for the year ended December 31, 2005, filed with

the Securities and Exchange Commission (SEC) and available on the SEC’s website at www.sec.gov.

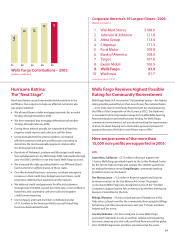

5%

.5

17

12

21

11

10 15 205 years

(percent) Wells Fargo Common Stock S&P 500

LONG-TERM PERFORMANCE – TOTAL COMPOUND ANNUAL

STOCKHOLDER RETURN (Including reinvestment of dividends)

21

9

Financial Review