Wells Fargo 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

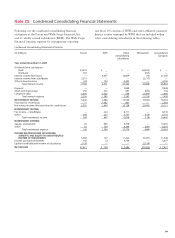

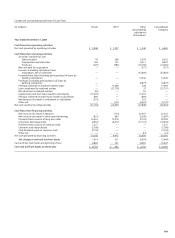

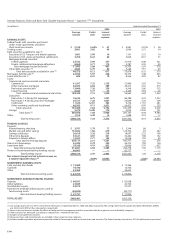

(in millions) December 31,

2005 2004

Notional or Credit Estimated Notional or Credit Estimated

contractual risk net fair contractual risk net fair

amount amount

(1) value amount amount(1) value

ASSET/LIABILITY MANAGEMENT

HEDGES

Interest rate contracts:

Swaps $ 36,978 $ 409 $ 26 $ 27,145 $ 626 $ 524

Futures 25,485 — — 10,314 — —

Floors and caps purchased 5,250 87 87 1,400 25 25

Floors and caps written 5,250 — (13) ———

Options purchased 26,508 103 103 51,670 49 49

Options written 405 1 (3) ———

Forwards 106,146 126 18 103,948 137 113

Equity contracts:

Options purchased 31 1 25 1 1

Options written 75 — (3) 99 — (18)

Forwards 15 2 2 19 1 —

Foreign exchange contracts:

Swaps 4,217 142 93 ———

Forwards 1,000 11 — ———

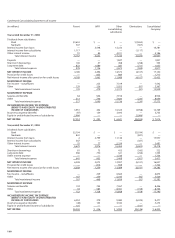

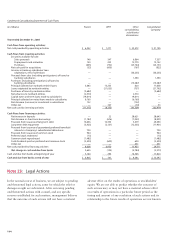

CUSTOMER ACCOMMODATIONS

AND TRADING

Interest rate contracts:

Swaps 92,462 1,175 133 74,659 1,631 28

Futures 251,534 — — 152,943 — —

Floors and caps purchased 7,169 33 33 32,715 170 170

Floors and caps written 12,653 — (27) 34,119 1 (189)

Options purchased 10,160 129 129 699 4 4

Options written 41,124 41 (160) 26,418 45 (45)

Forwards 56,644 17 (61) 46,167 13 (19)

Commodity contracts:

Swaps 20,633 599 (1) 4,427 141 (27)

Futures 555 — — 230 — —

Floors and caps purchased 5,464 195 195 391 39 39

Floors and caps written 6,356 — (130) 609 — (37)

Options purchased 12 7 7 35 17 17

Options written 52 — (33) 42 — (6)

Equity contracts:

Swaps 55 5 (2) 4——

Futures 480 — — 730 — —

Options purchased 1,810 253 253 1,011 189 189

Options written 1,601 — (263) 935 — (181)

Foreign exchange contracts:

Swaps 1,078 35 1 673 53 52

Futures 53 — — 24 — —

Options purchased 2,280 60 60 2,211 79 79

Options written 2,219 — (59) 2,187 — (79)

Forwards and spots 21,516 220 22 25,788 489 19

Credit contracts:

Swaps 5,454 23 (33) 5,443 36 (22)

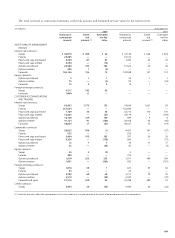

The total notional or contractual amounts, credit risk amount and estimated net fair value for derivatives were:

(1) Credit risk amounts reflect the replacement cost for those contracts in a gain position in the event of nonperformance by all counterparties.