Wells Fargo 2005 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

Fortunately for our customers, every single one of these misguided

attempts has failed. When states and local governments announce

these lawsuits, they often attract significant media coverage.

But when they’re adjudicated in the courts—which have

consistently ruled in favor of national banks on these issues—

the stories are buried or not reported at all.

2006: The Economy

This coming year will be challenging for the banking industry.

Asset yields do not seem to account for risk. Credit quality

can’t get much better. The yield curve—the difference between

short-term and long-term interest rates—is likely to be flat, even

inverted. Banking competitors are, once again, relaxing loan

terms while not fully pricing for this risk. However, Wells Fargo’s

business model, now in place for nearly 20 years, focuses on

selling more products to existing customers and, therefore,

gaining both market share and wallet share. Perhaps that’s why

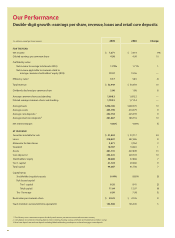

Wells Fargo produced consistent double-digit increases in both

revenue and earnings per share over the past 20, 15, 10 and

five years, which included almost every economic condition

a financial institution can face, not unlike those that may exist

in 2006.

The Next Stage

Once again, we thank our 153,000 talented team members

for their outstanding accomplishments and record results not

just for this year but for the past 20 years. We thank our

customers for entrusting us with more of their business and for

returning to us for their next financial services product. We thank

our communities—thousands of them across North America—

that we partner with to make them better places to live and

work. And we thank you, our owners, for your confidence in

Wells Fargo as we begin our 155th year (March 1852).

A special thank you

Two members of our Board will retire this April after a total of

three decades of service to our company.

Dr. Reatha Clark King, retired president

and board chair of the General Mills

Foundation, Minneapolis, Minnesota,

joined the Board 20 years ago when the

former Norwest Corporation had assets

of just over $21 billion. Most recently she

served on the audit and examination, and

the finance committees.

Gus Blanchard, chairman of ADC

Telecommunications, Inc., Eden Prairie,

Minnesota, joined our Board 10 years

ago, when we had assets of just over

$80 billion. Most recently, he served on

the audit and examination, credit, and

governance and nominating committees.

Their wise counsel and thoughtful guidance has helped our

company achieve remarkable growth during their tenures while

we built a reputation as one of the world’s most admired financial

services companies. Thank you, Reatha and Gus!

The “Next Stage” of success is just down the road—for our team

members, our customers, our communities and our stockholders.

It’s going to be a great ride!

Richard M. Kovacevich, Chairman and CEO