Wells Fargo 2005 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

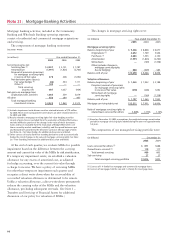

Mortgage banking activities, included in the Community

Banking and Wholesale Banking operating segments,

consist of residential and commercial mortgage originations

and servicing.

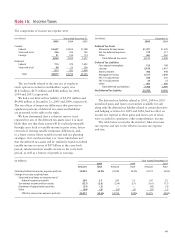

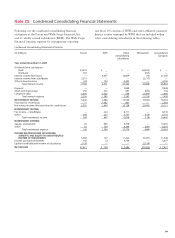

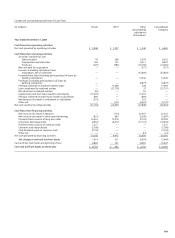

The components of mortgage banking noninterest

income were:

Note 21: Mortgage Banking Activities

(in millions) Year ended December 31,

2005 2004 2003

Servicing income, net:

Servicing fees (1) $ 2,457 $ 2,101 $ 1,787

Amortization (1,991) (1,826) (2,760)

Reversal of provision (provision)

for mortgage servicing rights

in excess of fair value 378 208 (1,092)

Net derivative gains (losses):

Fair value hedges (2) (46) 554 1,111

Other (3) 189 — —

Total servicing

income, net 987 1,037 (954)

Net gains on mortgage loan

origination/sales activities 1,085 539 3,019

All other 350 284 447

Total mortgage banking

noninterest income $ 2,422 $ 1,860 $ 2,512

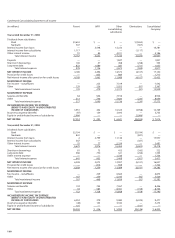

At the end of each quarter, we evaluate MSRs for possible

impairment based on the difference between the carrying

amount and current fair value of the MSRs by risk stratification.

If a temporary impairment exists, we establish a valuation

allowance for any excess of amortized cost, as adjusted

for hedge accounting, over the current fair value through

a charge to income. We have a policy of reviewing MSRs

for other-than-temporary impairment each quarter and

recognize a direct write-down when the recoverability of

a recorded valuation allowance is determined to be remote.

Unlike a valuation allowance, a direct write-down permanently

reduces the carrying value of the MSRs and the valuation

allowance, precluding subsequent reversals. (See Note 1 –

Transfers and Servicing of Financial Assets for additional

discussion of our policy for valuation of MSRs.)

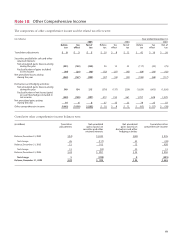

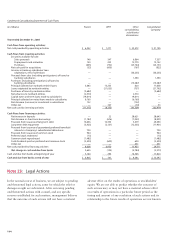

(in millions) Year ended December 31,

2005 2004 2003

Mortgage servicing rights:

Balance, beginning of year $ 9,466 $ 8,848 $ 6,677

Originations (1) 2,652 1,769 3,546

Purchases (1) 2,683 1,353 2,140

Amortization (1,991) (1,826) (2,760)

Write-down —(169) (1,338)

Other (includes changes in

mortgage servicing rights

due to hedging) 888 (509) 583

Balance, end of year $13,698 $ 9,466 $ 8,848

Valuation allowance:

Balance, beginning of year $ 1,565 $ 1,942 $ 2,188

Provision (reversal of provision)

for mortgage servicing rights

in excess of fair value (378) (208) 1,092

Write-down of mortgage

servicing rights —(169) (1,338)

Balance, end of year $ 1,187 $ 1,565 $ 1,942

Mortgage servicing rights, net $12,511 $ 7,901 $ 6,906

Ratio of mortgage servicing rights to

related loans serviced for others 1.44% 1.15% 1.15%

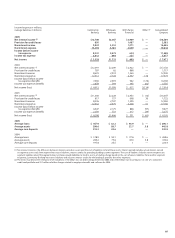

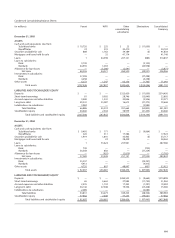

(in billions) December 31,

2005 2004

Loans serviced for others (1) $ 871 $688

Owned loans serviced (2) 118 117

Total owned servicing 989 805

Sub-servicing 27 27

Total managed servicing portfolio $1,016 $832

(1) Consists of 1-4 family first mortgage and commercial mortgage loans.

(2) Consists of mortgages held for sale and 1-4 family first mortgage loans.

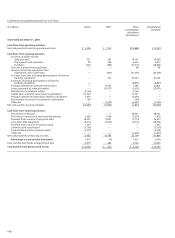

(1) Based on December 31, 2005, assumptions, the weighted-average amortization

period for mortgage servicing rights added during the year was approximately

5.6 years.

(1) Includes impairment write-downs on other retained interests of $79 million

for 2003.There were no impairment write-downs on other retained interests

for 2005 and 2004.

(2) Results related to mortgage servicing rights fair value hedging activities

consist of gains (losses) excluded from the evaluation of hedge effectiveness

and the ineffective portion of the change in the value of these derivatives.

Gains and losses excluded from the evaluation of hedge effectiveness are

those caused by market conditions (volatility) and the spread between spot

and forward rates priced into the derivative contracts (the passage of time).

See Note 26 – Fair Value Hedges for additional discussion and detail.

(3) Other consists of results from free-standing derivatives used to economically

hedge the risk of changes in fair value of mortgage servicing rights. See Note

26 – Free-Standing Derivatives for additional discussion and detail.

The changes in mortgage servicing rights were:

The components of our managed servicing portfolio were: