Wells Fargo 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

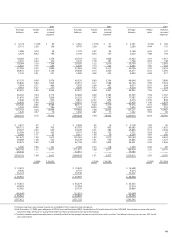

Table 9: Contractual Obligations

(in millions) Note(s) to Less than 1-3 3-5 More than Indeterminate Total

Financial Statements 1 year years years 5 years maturity (1)

Contractual payments by period:

Deposits 10 $80,461 $ 5,785 $ 1,307 $ 231 $226,666 $314,450

Long-term debt (2) 7, 12 11,124 27,704 15,869 24,971 — 79,668

Operating leases 7 514 786 535 898 — 2,733

Purchase obligations (3) 548 244 28 — — 820

Total contractual obligations $92,647 $34,519 $17,739 $26,100 $226,666 $397,671

(1) Represents interest-bearing and noninterest-bearing checking, market rate and other savings accounts.

(2) Includes capital leases of $14 million.

(3) Represents agreements to purchase goods or services.

cycle can vary based on market conditions and the industry

in which the companies operate. We expect that many of

these investments will become public, or otherwise become

liquid, before the balance of unfunded equity commitments

is used. At December 31, 2005, these commitments were

approximately $650 million. Our other investment commit-

ments, principally related to affordable housing, civic and

other community development initiatives, were approximately

$465 million at December 31, 2005.

In the ordinary course of business, we enter into indem-

nification agreements, including underwriting agreements

relating to offers and sales of our securities, acquisition

agreements, and various other business transactions or

arrangements, such as relationships arising from service as

a director or officer of the Company. For more information,

see Note 24 (Guarantees) to Financial Statements.

Contractual Obligations

In addition to the contractual commitments and arrange-

ments described above, which, depending on the nature of

the obligation, may or may not require use of our resources,

we enter into other contractual obligations in the ordinary

course of business, including debt issuances for the funding

of operations and leases for premises and equipment.

Table 9 summarizes these contractual obligations at

December 31, 2005, except obligations for short-term

borrowing arrangements and pension and postretirement

benefit plans. More information on these obligations is in

Note 11 (Short-Term Borrowings) and Note 15 (Employee

Benefits and Other Expenses) to Financial Statements. The

table also excludes other commitments more fully described

under “Off-Balance Sheet Arrangements, Variable Interest

Entities, Guarantees and Other Commitments.”

We enter into derivatives, which create contractual

obligations, as part of our interest rate risk management

process, for our customers or for other trading activities.

See “Asset/Liability and Market Risk Management” in this

report and Note 26 (Derivatives) to Financial Statements for

more information.

Transactions with Related Parties

FAS 57, Related Party Disclosures, requires disclosure of

material related party transactions, other than compensation

arrangements, expense allowances and other similar items in

the ordinary course of business. The Company had no related

party transactions required to be reported under FAS 57 for

the years ended December 31, 2005, 2004 and 2003.