Wells Fargo 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

Credit Risk Management Process

Our credit risk management process provides for decentral-

ized management and accountability by our lines of business.

Our overall credit process includes comprehensive credit

policies, frequent and detailed risk measurement and model-

ing, extensive credit training programs and a continual loan

audit review process. In addition, regulatory examiners

review and perform detailed tests of our credit underwriting,

loan administration and allowance processes.

Managing credit risk is a company-wide process. We have

credit policies for all banking and nonbanking operations

incurring credit risk with customers or counterparties that

provide a consistent, prudent approach to credit risk man-

agement. We use detailed tracking and analysis to measure

credit performance and exception rates and we routinely

review and modify credit policies as appropriate. We have

corporate data integrity standards to ensure accurate and

complete credit performance reporting. We strive to identify

problem loans early and have dedicated, specialized collec-

tion and work-out units.

The Chief Credit Officer, who reports directly to the

Chief Executive Officer, provides company-wide credit over-

sight. Each business unit with direct credit risks has a credit

officer and has the primary responsibility for managing its

own credit risk. The Chief Credit Officer delegates authority,

limits and other requirements to the business units. These

delegations are routinely reviewed and amended if there are

significant changes in personnel, credit performance, or busi-

ness requirements. The Chief Credit Officer is a member of

the Company’s Management Committee.

Our business units and the office of the Chief Credit

Officer periodically review all credit risk portfolios to ensure

that the risk identification processes are functioning properly

and that credit standards are followed. Business units con-

duct quality assurance reviews to ensure that loans meet

portfolio or investor credit standards. Our loan examiners

and internal auditors also independently review portfolios

with credit risk.

Our primary business focus in middle-market commercial

and residential real estate, auto and small consumer lending,

results in portfolio diversification. We ensure that we use

appropriate methods to understand and underwrite risk.

In our wholesale portfolios, larger or more complex loans

are individually underwritten and judgmentally risk rated.

They are periodically monitored and prompt corrective

actions are taken on deteriorating loans. Smaller, more

homogeneous loans are approved and monitored using

statistical techniques.

Retail loans are typically underwritten with statistical

decision-making tools and are managed throughout their life

cycle on a portfolio basis. The Chief Credit Officer establishes

corporate standards for model development and validation

to ensure sound credit decisions and regulatory compliance.

Each business unit completes quarterly asset quality fore-

casts to quantify its intermediate-term outlook for loan losses

and recoveries, nonperforming loans and market trends. To

make sure our overall allowance for credit losses is adequate

we conduct periodic stress tests. This includes a portfolio loss

simulation model that simulates a range of possible losses

for various sub-portfolios assuming various trends in loan

quality. We assess loan portfolios for geographic, industry,

or other concentrations and use mitigation strategies, which

may include loan sales, syndications or third party insurance,

to minimize these concentrations, as we deem necessary.

We routinely review and evaluate risks that are not

borrower specific but that may influence the behavior of a

particular credit, group of credits or entire sub-portfolios. We

also assess risk for particular industries, geographic locations

such as states or Metropolitan Statistical Areas (MSAs) and

specific macroeconomic trends.

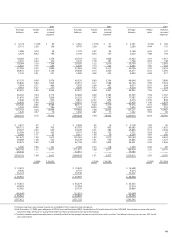

NONACCRUAL LOANS AND OTHER ASSETS

Table 10 shows the five-year trend for nonaccrual loans

and other assets. We generally place loans on nonaccrual

status when:

• the full and timely collection of interest or principal

becomes uncertain;

• they are 90 days (120 days with respect to real estate

1-4 family first and junior lien mortgages) past due for

interest or principal (unless both well-secured and in

the process of collection); or

• part of the principal balance has been charged off.

Note 1 (Summary of Significant Accounting Policies) to

Financial Statements describes our accounting policy for

nonaccrual loans.

The decrease in nonaccrual loans was primarily due

to payoffs of commercial and commercial real estate

nonaccrual loans.

We expect that the amount of nonaccrual loans will

change due to portfolio growth, portfolio seasoning, routine

problem loan recognition and resolution through collections,

sales or charge-offs. The performance of any one loan can

be affected by external factors, such as economic conditions,

or factors particular to a borrower, such as actions of a

borrower’s management.

If interest due on the book balances of all nonaccrual

loans (including loans that were but are no longer on nonac-

crual at year end) had been accrued under the original terms,

approximately $85 million of interest would have been

recorded in 2005, compared with payments of $35 million

recorded as interest income.

Most of the foreclosed assets at December 31, 2005, have

been in the portfolio one year or less.

Risk Management