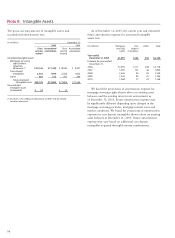

Wells Fargo 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

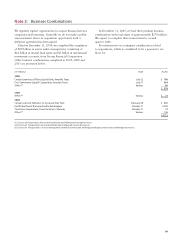

We regularly explore opportunities to acquire financial services

companies and businesses. Generally, we do not make a public

announcement about an acquisition opportunity until a

definitive agreement has been signed.

Effective December 31, 2004, we completed the acquisition

of $29 billion in assets under management, consisting of

$24 billion in mutual fund assets and $5 billion in institutional

investment accounts, from Strong Financial Corporation.

Other business combinations completed in 2005, 2004 and

2003 are presented below.

Note 2: Business Combinations

At December 31, 2005, we had three pending business

combinations with total assets of approximately $278 million.

We expect to complete these transactions by second

quarter 2006.

For information on contingent consideration related

to acquisitions, which is considered to be a guarantee, see

Note 24.

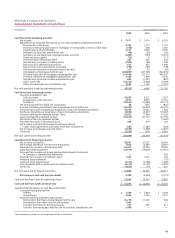

(in millions) Date Assets

2005

Certain branches of PlainsCapital Bank, Amarillo,Texas July 22 $ 190

First Community Capital Corporation, Houston, Texas July 31 644

Other

(1)

Various 40

$ 874

2004

Other

(2)

Various $ 74

2003

Certain assets of Telmark, LLC, Syracuse, New York February 28 $ 660

Pacific Northwest Bancorp, Seattle, Washington October 31 3,245

Two Rivers Corporation, Grand Junction, Colorado October 31 74

Other

(3)

Various 136

$ 4,115

(1) Consists of 8 acquisitions of insurance brokerage and lockbox processing businesses.

(2) Consists of 13 acquisitions of insurance brokerage and payroll services businesses.

(3) Consists of 14 acquisitions of asset management, commercial real estate brokerage, bankruptcy and insurance brokerage businesses.