Wells Fargo 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

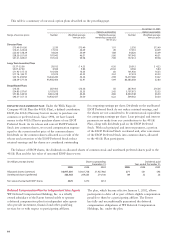

We are authorized to issue 20 million shares of preferred

stock and 4 million shares of preference stock, both without

par value. Preferred shares outstanding rank senior to com-

mon shares both as to dividends and liquidation preference

but have no general voting rights. We have not issued any

preference shares under this authorization.

ESOP CUMULATIVE CONVERTIBLE PREFERRED STOCK

All shares of our ESOP (Employee Stock Ownership Plan)

Cumulative Convertible Preferred Stock (ESOP Preferred

Stock) were issued to a trustee acting on behalf of the

Wells Fargo & Company 401(k) Plan (the 401(k) Plan).

Dividends on the ESOP Preferred Stock are cumulative

from the date of initial issuance and are payable quarterly

Note 13: Preferred Stock

at annual rates ranging from 8.50% to 12.50%, depending

upon the year of issuance. Each share of ESOP Preferred

Stock released from the unallocated reserve of the 401(k)

Plan is converted into shares of our common stock based

on the stated value of the ESOP Preferred Stock and the

then current market price of our common stock. The ESOP

Preferred Stock is also convertible at the option of the holder

at any time, unless previously redeemed. We have the option

to redeem the ESOP Preferred Stock at any time, in whole or

in part, at a redemption price per share equal to the higher

of (a) $1,000 per share plus accrued and unpaid dividends or

(b) the fair market value, as defined in the Certificates of

Designation for the ESOP Preferred Stock.

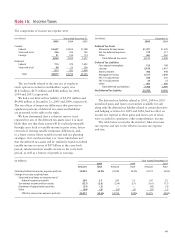

(1) Liquidation preference $1,000.

(2) In accordance with the American Institute of Certified Public Accountants (AICPA) Statement of Position 93-6, Employers’ Accounting for Employee Stock Ownership

Plans, we recorded a corresponding charge to unearned ESOP shares in connection with the issuance of the ESOP Preferred Stock.The unearned ESOP shares are

reduced as shares of the ESOP Preferred Stock are committed to be released. For information on dividends paid, see Note 14.

Shares issued Carrying amount

and outstanding (in millions) Adjustable

December 31, December 31, dividend rate

2005 2004 2005 2004 Minimum Maximum

ESOP Preferred Stock (1):

2005 102,184 —$ 102 $ — 9.75% 10.75%

2004 74,880 89,420 75 90 8.50 9.50

2003 52,643 60,513 53 61 8.50 9.50

2002 39,754 46,694 40 47 10.50 11.50

2001 28,263 34,279 28 34 10.50 11.50

2000 19,282 24,362 19 24 11.50 12.50

1999 6,368 8,722 69 10.30 11.30

1998 1,953 2,985 23 10.75 11.75

1997 136 2,206 —2 9.50 10.50

1996 — 382 ——8.50 9.50

Total ESOP Preferred Stock 325,463 269,563 $ 325 $ 270

Unearned ESOP shares (2) $(348) $(289)