Wells Fargo 2005 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2005 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

identification to help these customers move from the risky,

cash economy to secure, reliable financial services.

• In Los Angeles and Orange counties, we launched a pilot

program to offer mortgage loans to employed, taxpaying cus-

tomers who have an individual taxpayer identification number

(ITIN) issued by the IRS but do not have a Social Security

number.1If successful, we hope to roll this mortgage product

out across all 23 of our community banking states.

• We increased the Company’s quarterly dividend more than

8 percent to 52 cents a share, the 18th consecutive year we’ve

increased our dividend, our 23rd dividend increase since 1988.

We’re the nation’s 13th largest dividend payer and one of less

than 3 percent of more than 10,000 North American-listed,

dividend-paying common stocks classified as a “Dividend

Achiever”—a publicly-traded company that has increased its

dividends for the last 10 or more consecutive years.2If you

had invested $10,000 in 1986 in our predecessor company,

Norwest Corporation, it would have been worth $435,000

at year-end 2005 with dividends reinvested.

• Our total managed and administered assets rose 6 percent

to $880 billion. The new Wells Fargo Advantage FundsSM —

the result of the merger of Wells Fargo Funds®and Strong

Funds®—is the nation’s 18th-largest mutual fund company,

managing $108 billion in assets, with 120 funds spanning

almost all asset classes and investment styles.

• We announced a 10-point commitment to integrate

environmental responsibility into our business practices.

This includes a pledge to provide more than $1 billion in the

next five years, in lending, investments and other financial

commitments to environmentally-beneficial business oppor-

tunities including sustainable forestry, renewable energy,

water-resource management, waste management, “green

home” construction and development, and energy efficiency.

1 Qualified individuals must have been customers of Wells Fargo Bank for six months, paid U.S. taxes

for two years,must be able to prove two years of California residence.

2 Mergent,Inc.

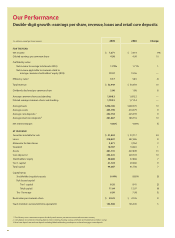

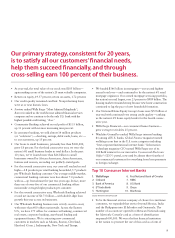

Double-Digit Annual Compound

Growth – for 20 Years

Total Stockholder Return

Years EPS Revenue Wells Fargo S&P 500®

5 14% 10% 5% 0.5%

10 11 13 17 9

15 12 12 21 11

20 14 12 21 12

Impressive results, indeed. We’re very proud of them. But, believe

it or not, we can do even better. In recent annual reports, we told

you that we’ve not been growing our business banking and

investment businesses at a rate consistent with their potential.

I’m pleased to report we’re making significant progress.

Business Banking

Just two years ago, our average Business Banking customer—

businesses with annual revenue up to $20 million—had only

about 2.7 products with us—dead last in cross-sell among all

our businesses. Also, less than one of every four of our Business

Banking customers did their personal banking with Wells Fargo.

Less than one of every 10 gave us their investment business.

Two years ago we said that by 2008 we wanted to double rev-

enue and cross-sell and dramatically increase our market share

for both deposits and loans from our small business customers.

I’m pleased to report that our Business Banking cross-sell grew

11 percent for the year. Our Business Banking team surpassed

an average of 3.0 products (or “solutions”) per customer.

The number of business customers actively using online banking

grew 24 percent. Our Business Banking deposits—which grew

10 percent in 2004—rose another 9 percent in 2005. During

those same years our loans and lines of credit—primarily less

than $100,000, sold to our small business customers through

our banking stores, online, direct mail, teleconsulting and

in-bound calls—rose 17 percent and 18 percent, respectively.

Our business customers are buying their financial products

from someone. Since we believe we can offer them a superior

value, there’s no reason we shouldn’t earn all their financial

services business—business, personal and investments. In 2004

Wells Fargo was #1 for the third year in a row in loans under

$100,000 to small businesses, with 15 percent market share

nationally. We also were the #1 lender to small businesses in

low-to-moderate income neighborhoods, with almost 16 percent

market share, nationwide.